Les services de conseil sont le moteur silencieux de la croissance, de l'innovation et des améliorations opérationnelles de nombreuses entreprises. Malgré cela, les dépenses de conseil sont souvent mises dans le même sac que les catégories d'achats indirects comme les voyages et les assurances - considérées comme une dépense de plus plutôt que comme un moteur essentiel de la réussite de l'entreprise. Cette catégorisation erronée mine non seulement le véritable potentiel des services de conseil, mais limite également les possibilités d'utilisation de ces services. valeur stratégique qu'ils peuvent apporter à l'organisation.

Contrairement aux catégories traditionnelles d'achats indirects, telles que les fournitures de bureau ou les assurances, le conseil a un impact direct sur les fonctions essentielles de l'entreprise. Qu'il s'agisse de guider une entreprise dans sa transformation numérique, de rationaliser ses opérations ou de susciter de nouvelles sources de revenus, les services de conseil peuvent influencer de manière significative le résultat net et le résultat net. Traiter ces dépenses comme un coût transactionnel plutôt que comme un investissement stratégique laisse une valeur significative inexploitée.

C'est là que la gestion des catégories intervient. En tant qu'approche structurée des achats, la gestion par catégorie permet aux organisations de segmenter leurs dépenses, de les aligner sur les objectifs de l'entreprise et d'optimiser les performances des fournisseurs. En appliquant les principes de la gestion par catégorie au conseil, les entreprises peuvent en exploiter tout le potentiel - en améliorant les résultats, en favorisant de meilleures relations avec les fournisseurs et en créant de la valeur à long terme.

La gestion du conseil en tant que catégorie distincte, séparée des autres services professionnels, permet des stratégies plus nuancées de la part des fournisseurs et un alignement plus clair sur les objectifs de l'entreprise. Les dépenses de conseil représentant généralement entre 0,51 et 31 tonnes de chiffre d'affaires, le potentiel de création de valeur est immense. Les entreprises qui le reconnaissent et qui traitent le conseil comme un atout stratégique, plutôt que comme un coût indirect, seront celles qui resteront en tête sur le marché concurrentiel d'aujourd'hui.

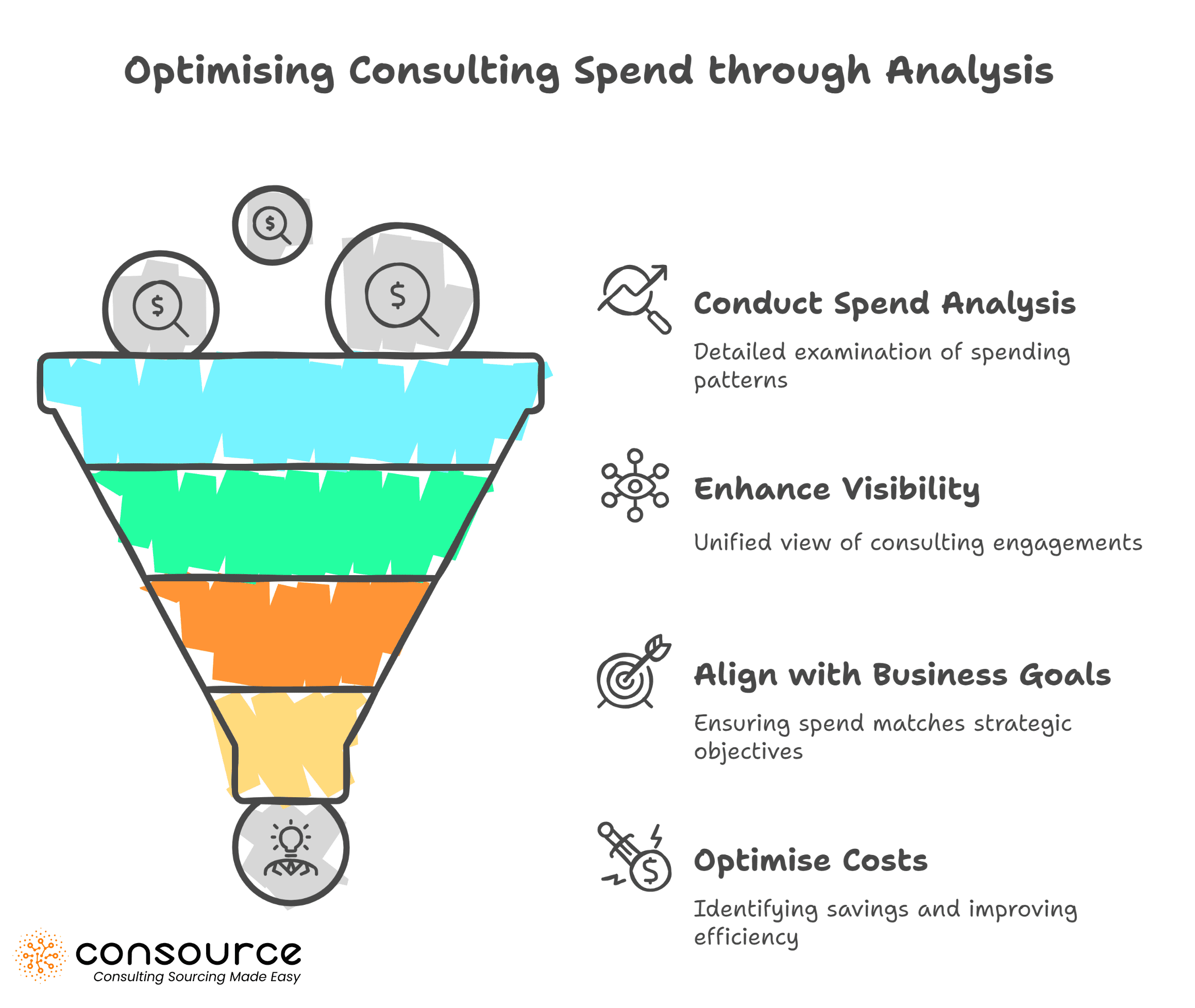

#1. Analyse des dépenses : Comprendre où va l'argent

Pour gérer efficacement le conseil en tant que catégorie stratégique, vous devez savoir exactement où va votre argent. Analyse des dépenses est la première étape critique de ce processus, car elle offre un aperçu détaillé des montants dépensés pour les services de conseil, de l'endroit où ils sont dépensés et de leurs destinataires.

Si la valeur stratégique du conseil a été soulignée, l'analyse des dépenses fournit les données concrètes qui permettent aux équipes chargées des achats et aux dirigeants de prendre des décisions éclairées. Sans ces informations, les entreprises sont dans l'incapacité de tirer le meilleur parti des services de conseil et d'en maximiser l'impact.

Visibilité : Faire la lumière sur les dépenses de conseil

Une analyse complète des dépenses fournit une visibilité indispensable sur les engagements de conseil dans l'ensemble de l'organisation. Dans de nombreuses entreprises, les dépenses de conseil sont fragmentées, les différents départements faisant appel à divers consultants de manière indépendante. Sans une vision unifiée, il est pratiquement impossible d'avoir une vue d'ensemble, et encore moins de s'assurer que les projets de conseil sont alignés sur les objectifs de l'entreprise.

En regroupant les dépenses de conseil des différents services et divisions, l'analyse des dépenses offre une vue d'ensemble du paysage du conseil au sein de l'entreprise. Elle permet de savoir qui utilise les services de conseil, combien ils dépensent et quels sont les résultats obtenus. Cette visibilité permet aux équipes chargées des achats d'identifier les redondances, par exemple lorsque plusieurs services font appel à différents consultants pour des projets similaires, ou les opportunités manquées lorsque les services de conseil sont sous-utilisés.

Alignement : Assurer l'adéquation entre les dépenses de conseil et les priorités de l'entreprise

L'analyse des dépenses ne se contente pas de vous dire où va l'argent, elle vous aide à vous assurer que les dépenses de conseil sont alignées sur la stratégie globale de votre entreprise. Une fois que vous avez compris qui utilise des services de conseil et pourquoi, vous pouvez évaluer si ces engagements contribuent directement aux objectifs stratégiques de l'entreprise. Les projets soutiennent-ils des initiatives clés telles que la transformation numérique, la réduction des coûts ou l'expansion de nouveaux marchés ? Ou bien l'argent est-il dépensé dans des domaines peu prioritaires qui ne font pas bouger l'aiguille ?

En ayant une vision claire de l'utilisation des fonds alloués au conseil, les équipes chargées des achats peuvent travailler avec la direction pour aligner les projets futurs plus étroitement sur les priorités de l'entreprise. Cela permet de s'assurer que chaque engagement de conseil apporte une valeur mesurable et soutient les objectifs à long terme de l'entreprise.

Optimisation des coûts : Identifier les économies et améliorer l'efficacité

L'un des avantages les plus immédiats de l'analyse des dépenses est l'optimisation des coûts. En disposant d'une visibilité totale sur les missions de conseil, les entreprises peuvent identifier les domaines dans lesquels elles dépensent trop ou ratent des occasions de négocier de meilleures conditions.

Par exemple, une analyse des dépenses peut révéler que plusieurs départements font appel à la même société de conseil, mais que chacun paie un tarif différent. Le regroupement de ces missions et la négociation en tant qu'entité unifiée peuvent permettre de réaliser d'importantes économies.

En outre, l'analyse des dépenses peut mettre en évidence des ressources sous-utilisées. Par exemple, si certains consultants sont engagés pour de petits projets non critiques, alors que leur expertise pourrait être mise à profit pour des initiatives plus importantes et ayant plus d'impact, les entreprises peuvent réaffecter ces ressources afin d'en maximiser la valeur. Ce type d'optimisation permet de s'assurer que les dépenses de conseil sont non seulement contrôlées mais aussi pleinement utilisées pour améliorer les résultats de l'entreprise.

Les données au service de la prise de décision stratégique

Les informations obtenues grâce à l'analyse des dépenses permettent aux équipes chargées des achats et aux dirigeants de prendre des décisions fondées sur des données concernant l'utilisation des services de conseil. Plutôt que de se fier à leur intuition ou à des preuves anecdotiques, les entreprises peuvent fonder leur stratégie d'achat de services de conseil sur des faits concrets. Cela permet de fixer des budgets réalistes, de négocier plus efficacement avec les sociétés de conseil et de s'assurer que chaque dollar dépensé contribue à la réalisation des objectifs stratégiques.

En bref, l'analyse des dépenses est le fondement d'une gestion efficace des catégories de conseil. En fournissant une visibilité sur les modèles de dépenses, en alignant les engagements de conseil sur les priorités de l'entreprise et en identifiant les opportunités d'optimisation des coûts, elle transforme ce qui était autrefois un domaine nébuleux de l'approvisionnement en une fonction axée sur les données et les résultats. Pour les entreprises désireuses de considérer le conseil comme un actif stratégique, l'analyse des dépenses n'est pas seulement utile, elle est essentielle.

#2. Analyse de marché : Tirer parti des connaissances pour un avantage stratégique

Comprendre le marché du conseil est essentiel pour maximiser la valeur de vos dépenses en conseil. Si de nombreuses entreprises reconnaissent l'importance de connaître leurs schémas de dépenses internes, moins nombreuses sont celles qui tirent pleinement parti de l'analyse du marché pour éclairer leurs décisions en matière d'achat de services de conseil.

L'analyse de marché va au-delà de la connaissance des principaux acteurs - il s'agit de comprendre le paysage complet des consultants disponibles, de rester compétitif et de tirer parti de la position de votre entreprise pour obtenir les meilleures offres et les meilleurs partenaires. Cette approche proactive est essentielle pour garder une longueur d'avance dans un environnement commercial qui évolue rapidement.

Identifier les bons consultants pour vos objectifs commerciaux

L'un des principaux avantages de l'analyse de marché est sa capacité à aider les entreprises à trouver les consultants les mieux adaptés à leurs besoins spécifiques. Les cabinets de conseil varient considérablement en termes d'expertise, de capacités et de modèles de tarification. Alors que certains peuvent exceller dans la stratégie et l'innovation, d'autres peuvent être plus adaptés aux améliorations opérationnelles ou à la transformation numérique. Une analyse approfondie du marché permet aux entreprises d'identifier les cabinets les mieux équipés pour relever leurs défis uniques.

Par exemple, si votre entreprise est en pleine transformation numérique, l'analyse de marché peut vous aider à identifier les sociétés de conseil qui ont fait leurs preuves dans ce domaine. Elle peut également mettre en évidence des entreprises de niche plus petites qui n'étaient peut-être pas dans votre champ de vision mais qui offrent une expertise spécialisée correspondant parfaitement à vos objectifs. En déterminant les capacités des différentes sociétés de conseil, vous pouvez établir une liste restreinte de partenaires potentiels qui sont les plus susceptibles de fournir les résultats souhaités.

Tirer parti de votre position en tant que client précieux

Une analyse de marché solide vous aide également à comprendre la valeur de votre entreprise sur le marché du conseil. Les grandes entreprises qui ont des besoins constants en matière de conseil, par exemple, peuvent avoir un plus grand pouvoir de négociation que les petites entreprises qui font appel à des consultants moins fréquemment. En connaissant votre position, vous pouvez utiliser ce levier pour négocier de meilleures conditions, obtenir des prix plus favorables et exiger des niveaux de service plus élevés.

Les sociétés de conseil sont désireuses de travailler avec des clients qui proposent des missions à long terme et à forte valeur ajoutée. L'analyse de marché peut montrer où se situe votre entreprise sur le marché plus large du conseil et vous aider à vous positionner en tant que client attractif. Cela permet non seulement de conclure de meilleures affaires, mais aussi de s'assurer que les meilleurs cabinets de conseil accordent la priorité à vos projets, en vous offrant leurs meilleures équipes et ressources. En abordant le marché en position de force, votre entreprise devient un partenaire recherché, capable d'attirer et de retenir les meilleurs consultants.

Rester compétitif et proactif dans un paysage en mutation

Le marché du conseil est en constante évolution, avec l'apparition de nouveaux acteurs, de nouvelles tendances et de nouvelles technologies. Une analyse de marché bien menée aide les entreprises à rester compétitives en les tenant informées de ces changements. Qu'il s'agisse de comprendre les nouvelles méthodologies en matière de conseil, d'identifier les entreprises émergentes qui proposent des solutions innovantes ou de repérer les tendances susceptibles d'avoir un impact sur votre activité, l'analyse de marché permet aux entreprises de garder une longueur d'avance.

Par exemple, comme de plus en plus d'entreprises se concentrent sur les solutions numériques, les sociétés qui recherchent de manière proactive des consultants spécialisés dans l'IA, l'analyse de données ou la transformation numérique seront mieux positionnées pour s'adapter et prospérer. Rester compétitif, ce n'est pas seulement réagir aux changements du marché, c'est aussi les anticiper et positionner votre entreprise pour tirer parti de nouvelles opportunités.

Découvrir de nouvelles opportunités de création de valeur

Au-delà de la simple recherche des bons consultants, l'analyse de marché ouvre la voie à la découverte de nouvelles opportunités de création de valeur. Elle aide les équipes chargées des achats et les chefs d'entreprise à voir où les besoins de leur entreprise en matière de conseil correspondent aux capacités inexploitées du marché. En comprenant l'ensemble des services disponibles, les entreprises peuvent explorer de nouvelles façons dont les consultants peuvent apporter une valeur ajoutée, que ce soit par l'innovation, l'amélioration des processus ou des initiatives stratégiques.

Par exemple, votre analyse de marché pourrait révéler que certains cabinets de conseil proposent des approches innovantes en matière de développement durable, un sujet qui pourrait correspondre aux objectifs à long terme de votre entreprise. L'identification de ces opportunités permet à votre organisation de s'engager avec des consultants qui peuvent vous aider à rester à la pointe des tendances du secteur et à relever des défis que vous n'aviez pas envisagés auparavant.

Entretenir des relations solides avec les principaux fournisseurs

L'analyse du marché ne se limite pas à l'identification des bons consultants ; elle joue également un rôle crucial dans le maintien de relations à long terme avec les principaux fournisseurs. En restant informé sur le marché du conseil, vous pouvez évaluer en permanence si vos partenaires actuels sont toujours les mieux adaptés à l'évolution de vos besoins. Cela vous permet de renégocier les contrats, d'ajuster les attentes et de vous assurer que vos consultants restent en phase avec vos objectifs commerciaux.

En bref, l'analyse de marché n'est pas seulement un outil permettant de trouver les bons consultants ; c'est un processus stratégique qui aide les entreprises à rester compétitives, à découvrir de nouvelles opportunités et à tirer parti de leur position sur le marché. En menant régulièrement des analyses de marché, les entreprises peuvent s'assurer qu'elles travaillent avec les meilleurs partenaires, qu'elles obtiennent les meilleurs contrats et qu'elles créent continuellement de la valeur grâce à leurs missions de conseil. Cette approche proactive permet à votre organisation de réussir dans un environnement commercial en constante évolution.

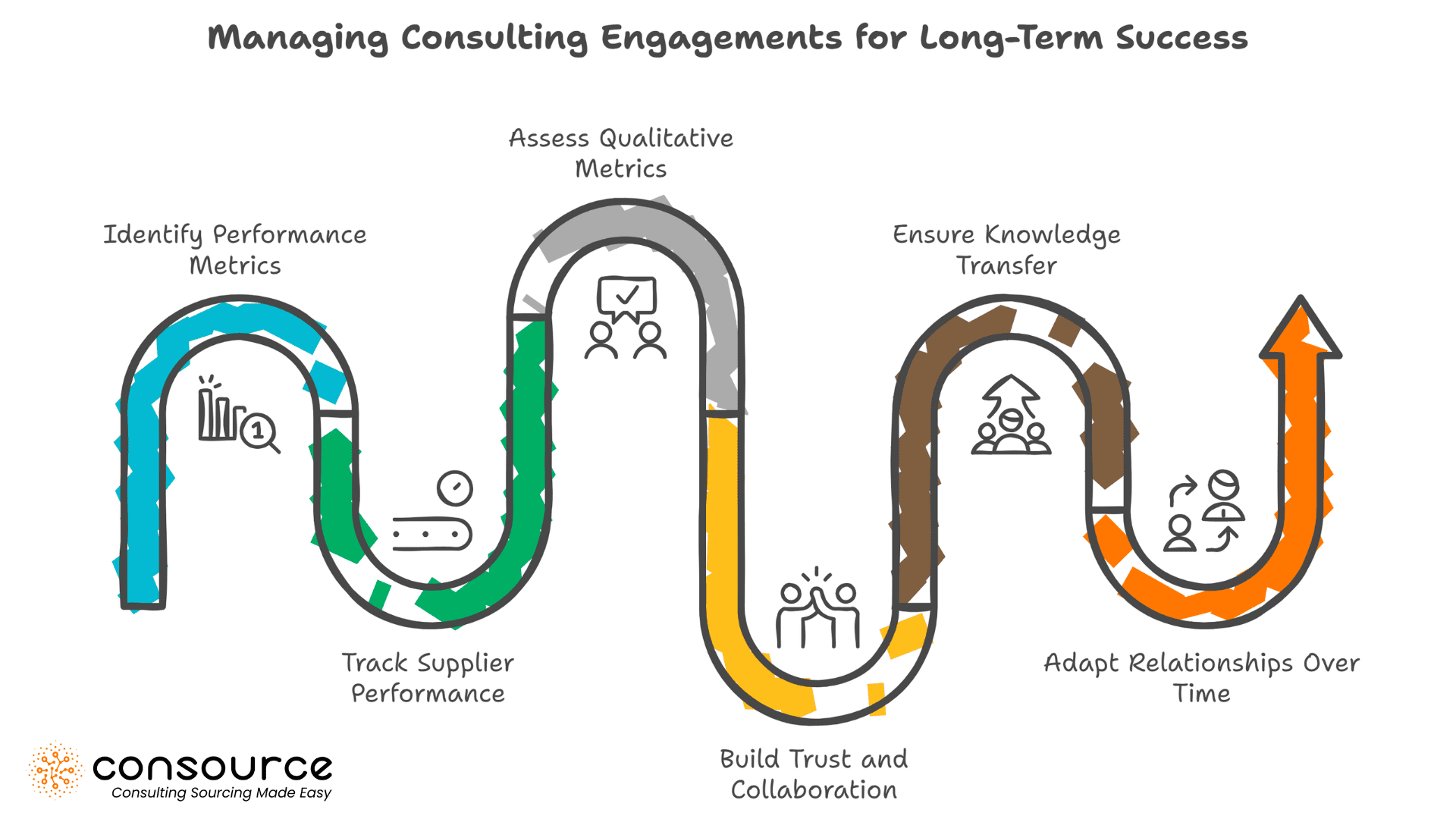

#3. Performance des fournisseurs et gestion des relations avec eux : Les deux piliers de la réussite à long terme

Lorsque l'on gère des missions de conseil, le succès ne consiste pas seulement à livrer les produits dans les délais et dans le respect du budget. Il s'agit également de cultiver des relations solides et à long terme qui apportent en permanence de la valeur au-delà de la portée immédiate du projet. La performance des fournisseurs et la gestion des relations vont de pair, et les entreprises qui parviennent à équilibrer ces deux éléments sont celles qui optimisent réellement leurs investissements en matière de conseil.

Si les mesures de performance offrent des indicateurs clairs de l'efficacité d'un consultant, ce sont les aspects plus doux et humains de la gestion des relations - la confiance, la collaboration et le transfert de connaissances - qui font souvent la différence entre un bon projet et un projet transformateur. Voyons pourquoi la performance des fournisseurs et la gestion des relations sont toutes deux essentielles à la création d'une valeur continue à partir de vos missions de conseil.

Mesures quantitatives : Suivi des performances des fournisseurs

Les indicateurs de performance des fournisseurs constituent l'épine dorsale de toute mission de conseil réussie. Ces chiffres concrets permettent de savoir si une société de conseil tient ses promesses. Les indicateurs clés de performance (ICP) pour les missions de conseil comprennent généralement des paramètres tels que le respect des délais, le respect du budget et la qualité des produits livrés.

En définissant ces paramètres au début d'un projet et en les révisant régulièrement, les équipes chargées des achats peuvent responsabiliser les sociétés de conseil. Les évaluations des performances doivent être structurées autour de ces données quantitatives, afin de s'assurer que les consultants respectent les délais, le budget et qu'ils fournissent des solutions conformes aux objectifs convenus.

Par exemple, si une société de conseil est constamment en retard ou dépasse le budget, ces mesures vous fournissent les données nécessaires pour résoudre les problèmes de performance et, le cas échéant, reconsidérer le partenariat. Le suivi des performances des fournisseurs garantit la transparence et constitue une base pour prendre des décisions éclairées sur les engagements futurs.

Mesures qualitatives : L'élément humain de la réussite en matière de conseil

Si les indicateurs quantitatifs sont essentiels, les missions de conseil sont par nature axées sur les personnes, ce qui rend les facteurs qualitatifs tout aussi importants. Il s'agit notamment de la capacité d'un consultant à établir une relation de confiance, à collaborer efficacement et à transférer des connaissances à vos équipes internes.

La nature du conseil signifie que vos partenaires externes sont souvent profondément ancrés dans votre organisation, travaillant en étroite collaboration avec les principales parties prenantes et les employés. Les compétences interpersonnelles d'un consultant - telles que sa capacité à établir des relations, à communiquer clairement et à naviguer dans des dynamiques organisationnelles complexes - peuvent avoir un impact significatif sur la réussite du projet. En revanche, une mauvaise dynamique interpersonnelle peut faire dérailler même les missions les mieux planifiées.

Par exemple, un consultant qui excelle dans le transfert de connaissances et l'autonomisation des équipes internes laissera un impact durable longtemps après la fin de la mission. Cela garantit que la valeur qu'il crée est durable, plutôt que de s'estomper une fois le projet terminé. Par conséquent, les évaluations qualitatives des performances doivent permettre de déterminer dans quelle mesure les consultants s'intègrent dans votre équipe, comment ils gèrent le retour d'information et avec quelle efficacité ils communiquent et collaborent tout au long du projet.

Instaurer la confiance et la collaboration pour des partenariats à long terme

Au-delà des indicateurs de performance, la gestion des relations est essentielle pour tirer une valeur à long terme des missions de conseil. Les relations solides reposent sur la confiance, et il faut du temps et des efforts constants pour cultiver la confiance. Lorsqu'une société de conseil se sent en confiance et appréciée en tant que partenaire, elle est plus encline à faire des efforts supplémentaires, à fournir des solutions innovantes et à s'investir dans votre réussite.

Une gestion efficace des relations implique une communication régulière, non seulement sur les performances, mais aussi sur les besoins futurs, les défis potentiels et les domaines à améliorer. Le fait de procéder à des contrôles fréquents et de maintenir des boucles de rétroaction ouvertes garantit que les problèmes sont réglés rapidement et que le consultant reste en phase avec l'évolution des besoins de votre entreprise.

En outre, la gestion des relations consiste à être proactif dans la construction d'un partenariat où les deux parties se sentent également investies. Cela signifie qu'il faut regarder au-delà du projet immédiat et envisager comment le consultant peut continuer à apporter une valeur ajoutée dans ses engagements futurs. Une relation solide et de confiance conduit à une meilleure collaboration, à une résolution plus innovante des problèmes et, en fin de compte, à de meilleurs résultats pour votre organisation.

Transfert de connaissances : Garantir un impact à long terme

L'un des aspects les plus critiques de la gestion des missions de conseil est d'assurer un transfert efficace des connaissances. Un projet réussi ne doit pas se contenter de fournir une solution à court terme, il doit donner à vos équipes internes les moyens de poursuivre le travail après le départ des consultants. C'est là que la gestion des relations et la performance s'entrecroisent. Vous avez besoin de consultants qui ne se contentent pas de résoudre efficacement les problèmes, mais qui sont également capables de former votre équipe et de lui transmettre des connaissances.

Une relation bien gérée encourage les consultants à investir dans le succès à long terme de votre organisation en fournissant les outils, les connaissances et les compétences dont vos équipes ont besoin pour continuer à progresser. Cela crée un effet d'entraînement où la valeur de l'engagement de conseil s'étend au-delà de la portée initiale du projet.

Adapter les relations au fil du temps : Flexibilité et retour d'information

Les relations de conseil, comme tout partenariat professionnel, doivent évoluer au fil du temps. Ce qui a fonctionné pour un projet peut ne pas convenir pour le suivant, et les besoins de l'entreprise évoluent souvent en fonction de sa croissance et de ses changements. Des évaluations régulières des performances, combinées à des efforts de renforcement des relations, permettent aux entreprises d'adapter ces partenariats en temps réel.

Les boucles de retour d'information sont essentielles à cet égard. En examinant régulièrement les performances et en ayant des conversations ouvertes sur ce qui fonctionne et ce qui doit être amélioré, le client et le cabinet de conseil peuvent tous deux procéder à des ajustements. Qu'il s'agisse de modifier la composition de l'équipe de projet, de changer d'orientation ou de revoir les délais, cette flexibilité garantit que le partenariat continue de répondre aux besoins des deux parties.

Conclusion : Consulting Category Management - Une décision audacieuse qui porte ses fruits

La gestion par catégorie est une méthodologie éprouvée pour les équipes chargées des achats, et ses principes sont de plus en plus adoptés dans tous les secteurs d'activité. Cependant, très peu d'entreprises reconnaissent le conseil comme une catégorie à part entière et lui accordent l'attention qu'il mérite. Le résultat ? Des opportunités manquées de création de valeur et d'optimisation dans un paysage de conseil complexe.

L'un des plus grands défis de la gestion du conseil en tant que catégorie stratégique est l'environnement complexe dans lequel il opère. Les parties prenantes internes détiennent souvent le pouvoir dans les décisions d'achat, contournant ainsi les équipes d'approvisionnement. En outre, les groupes chargés des achats indirects ont tendance à avoir moins d'influence que leurs homologues chargés des achats directs. Ce déséquilibre, associé à une méconnaissance générale de l'impact potentiel du conseil sur les résultats, maintient la gestion du conseil dans le statu quo.

Un autre facteur est le manque de reconnaissance de l'impact plus large que peuvent avoir les achats. Les achats sont souvent considérés comme une simple fonction de contrôle des coûts plutôt que comme un moteur stratégique de valeur. Cette perception fait qu'il est difficile de faire bouger les choses lorsque l'on plaide pour que le conseil soit géré comme une catégorie distincte. Mais pour les entreprises suffisamment audacieuses pour franchir ces barrières et traiter les dépenses de conseil comme un actif stratégique, les récompenses sont immenses.

En appliquant les principes de la gestion par catégorie au conseil, les entreprises peuvent réaliser des économies importantes, améliorer les performances des fournisseurs et, surtout, créer une valeur à long terme qui favorise la réussite de l'entreprise. Ces entreprises deviennent plus stratégiques dans leurs engagements de conseil, en veillant à ce que chaque projet contribue directement à leurs objectifs commerciaux et ait un impact mesurable.

Dans l'environnement commercial compétitif et rapide d'aujourd'hui, les organisations qui osent gérer le conseil comme une catégorie à part entière sont celles qui en récoltent les fruits. La vôtre en fera-t-elle partie ?

0 commentaires