Consulting fees are a perennial hot topic. Many clients balk at the costs, viewing consultants as too expensive and often hesitating to invest in consulting projects despite the high stakes and potential value. On the other hand, some clients readily meet consultants’ fees without a second thought, not stopping to consider whether the expense truly aligns with the expected benefits. In a world where understanding the nuances of consulting fees seems like a no-brainer, it’s surprising how often the basics are overlooked.

“Price is what you pay. Value is what you get.” – Warren Buffett’s wise words remind us that the true worth of consulting does not merely reside in the invoice you pay, but in the impactful results and strategic insights you gain. As clients and buyers, it’s crucial to keep your eyes on the prize: the tangible and intangible impacts that a well-executed consulting project can deliver.

Peeking Behind the Consulting Curtain

At its core, consulting is about selling time—or more precisely, access to expert knowledge and a skilled workforce for a specific period. Think of a consulting firm’s potential like seats on a flight: every day not billed is like a seat flying empty.

How Consultants Set Their Prices

When it comes to pricing, time is typically the main cost driver. Prices are usually pegged to the daily rate, multiplied by the number of days spent on the project. But it’s not just about counting days. Who’s on your team really counts. The gap in daily rates between a seasoned partner and a fresh-out-of-school analyst can be more than fivefold. Yes, experience doesn’t come cheap!

And then there’s the question of how much time they’re actually spending on your project. Full-time commitments are straightforward—the consultant parks at your site, and you see where your money is going. But part-time gigs? They’re a bit nebulous and can lead to surprises on your bill, especially if those high-flyers are only supposed to swoop in for a critical 10% of their time. Ever found yourself wondering where these experts are? You’re not alone.

Part-time work, especially from top-tier consultants, can seriously tilt your budget. The ramp-up and ramp-down phases should ideally be tied to distinct project milestones to keep things transparent.

The Other Things to Watch

Another often-overlooked aspect? The industry you’re in. Financial services and energy sectors might see a ‘luxury tax’ because consultants know the stakes (and budgets) are high. On the flip side, government and non-profits might catch a break on fees.

Speaking of budgets, keep a close eye on those out-of-pocket expenses. They can add up to 30% more to your project costs. To sidestep these potentially awkward talks, some firms go with an all-inclusive flat fee. No surprises there!

Navigating the Landscape of Consulting Fees

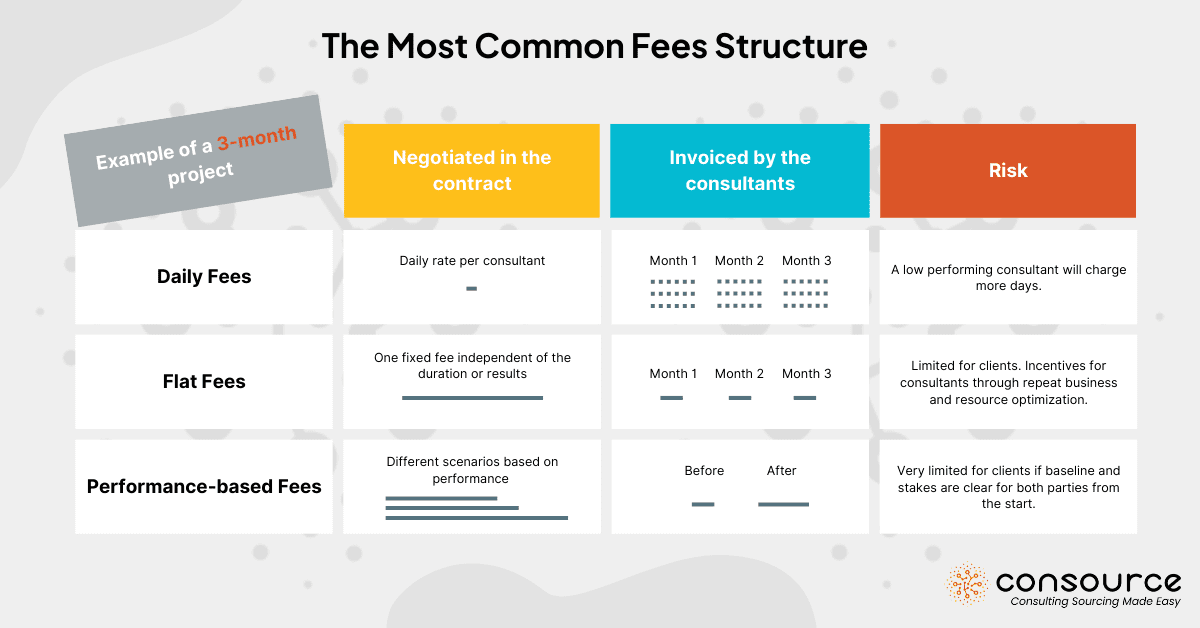

When it comes to consulting fees, think of them as falling into three main camps: fixed, variable based on time, and variable based on performance. Each type caters to different project needs and client risk appetites. If you’re a rookie in the consulting game or just prefer a straightforward approach, you might want to start with the queen of fees: the flat fee.

The Flat Fee: A Safe Bet for Beginners

Commonly known as fixed fees, flat fees are arguably the safest bet for clients new to consulting. This structure is the go-to for large projects where consultants assess the required work, expected deliverables, and the necessary expertise and time to deliver. By integrating these assessments with daily rates and additional costs, consultants craft a clear, upfront pricing proposal.

Increasingly, savvy consultants are also offering what’s known as value pricing—tying the flat fee to a percentage of the project’s anticipated value. This deviation from traditional daily rate calculations isn’t just about numbers; it’s about ensuring fairness in pricing while aligning the fee closely with the expected project outcomes.

For example, if a project is projected to deliver $10 million in value, the pressing question becomes whether negotiating down a consulting fee from $800,000 to $500,000 makes sense. This approach scrutinizes whether the fee represents a fair trade-off for the consultant’s expertise and the effort put into achieving the project’s goals.

Why Flat Fees Reign Supreme

Flat fees bring predictability to the table, making budgeting a breeze compared to the more dynamic nature of time-based or performance-based fees. With flat fees, you know exactly what you’re paying upfront, which can be particularly comforting if you’re dipping your toes into the consulting waters for the first time. It’s a straightforward, no-surprises approach that allows you to focus on what really matters—getting the desired results from your project without fretting over fluctuating costs.

While flat fees are often seen as a safe and predictable option, they aren’t without their drawbacks. Essentially, flat fees are most effective when consultants can deliver within the agreed timeframe, and when your organization is fully prepared to contribute necessary resources and effectively manage the project. However, there’s an inherent risk: consultants might not always be motivated to push boundaries or innovate beyond the agreed-upon scope, as doing so doesn’t necessarily align with their financial incentives.

In the colloquial French expression “Doucement le matin, pas trop vite le soir” (literally, “Gently in the morning, not too fast in the evening”), we find a playful yet cautionary note on the potential pacing of work under a flat fee structure. Consultants may pace their efforts to stretch out the project duration or set the stage for a sequel project, not because it benefits you, but because it suits their business model. This approach may go against the interest of clients who expect consultants to consistently strive for excellence and expedite results whenever possible.

Variable Fees Based on Time: Paying Only for the Work Done

One way to address potential limitations of flat fees, such as lack of flexibility and the risk of under-delivery, is to opt for variable fees based on time. This approach ensures you pay only for the work actually done, aligning costs directly with consultant efforts.

Time and Materials

This is the “pay-as-you-go” model in the consulting world. For smaller projects or those in exploratory phases, consultants may propose a negotiated daily rate. The total fee then accumulates based on the actual number of days spent on the project. While this structure offers flexibility and convenience, it also carries significant risks for the client as costs can quickly escalate with more days worked. To mitigate this, we recommend setting a cap on fees to prevent budget overruns. However, since compensation is directly tied to the number of days worked, this model may not always motivate consultants to prioritize quality and efficiency. It’s generally best suited to projects where the scope is not clearly defined or is likely to evolve.

Retainer Fees

On the other end of the spectrum are retainer fees, which involve paying a monthly charge based on a pre-agreed number of support hours or services. This model is akin to booking time from consultants that they then owe you, ensuring their availability. It’s particularly favored by coaches or trusted advisors and is ideal for ongoing consultancy needs. This ensures that consultants are continually available to provide steady streams of support and insights. It’s important to note that payment is required for the agreed hours whether they are fully utilized or not, emphasizing the need for strategic planning to maximize the value received from the consultant.

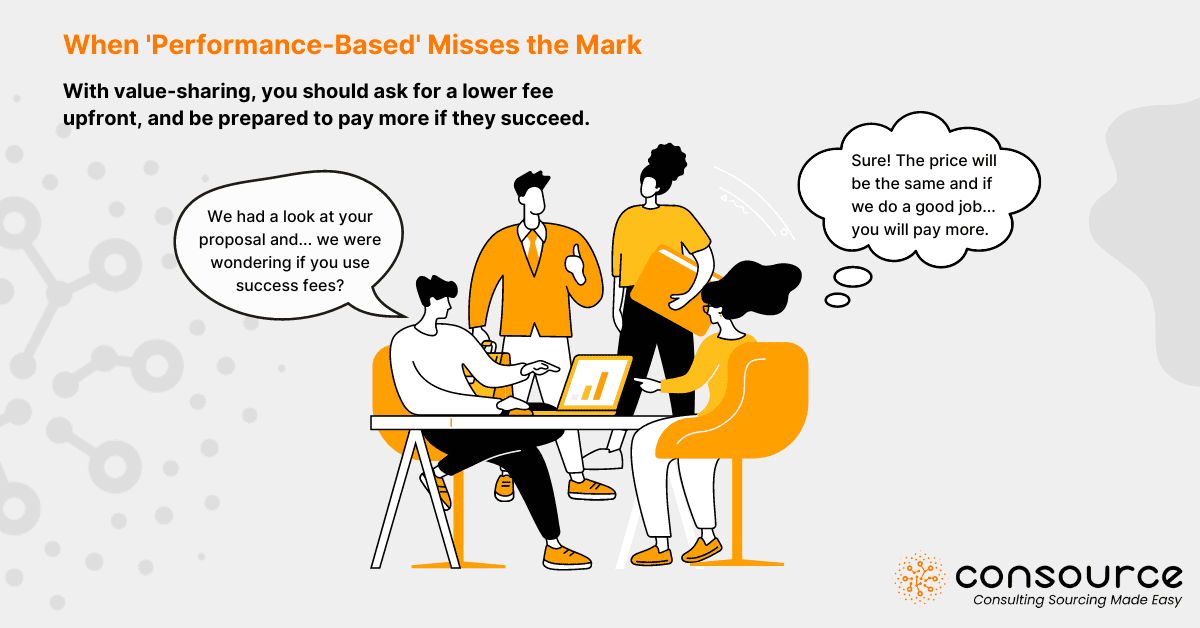

Variable Fees Based on Performance aka Success Fees

Another innovative way to solve the consulting fee conundrum is to base fees on performance. This approach is gaining traction as the “new kid on the block,” even though some clients—certainly not you—may be tempted to use it as a means to lower costs, which ironically can undermine the very mechanism it’s designed to enhance.

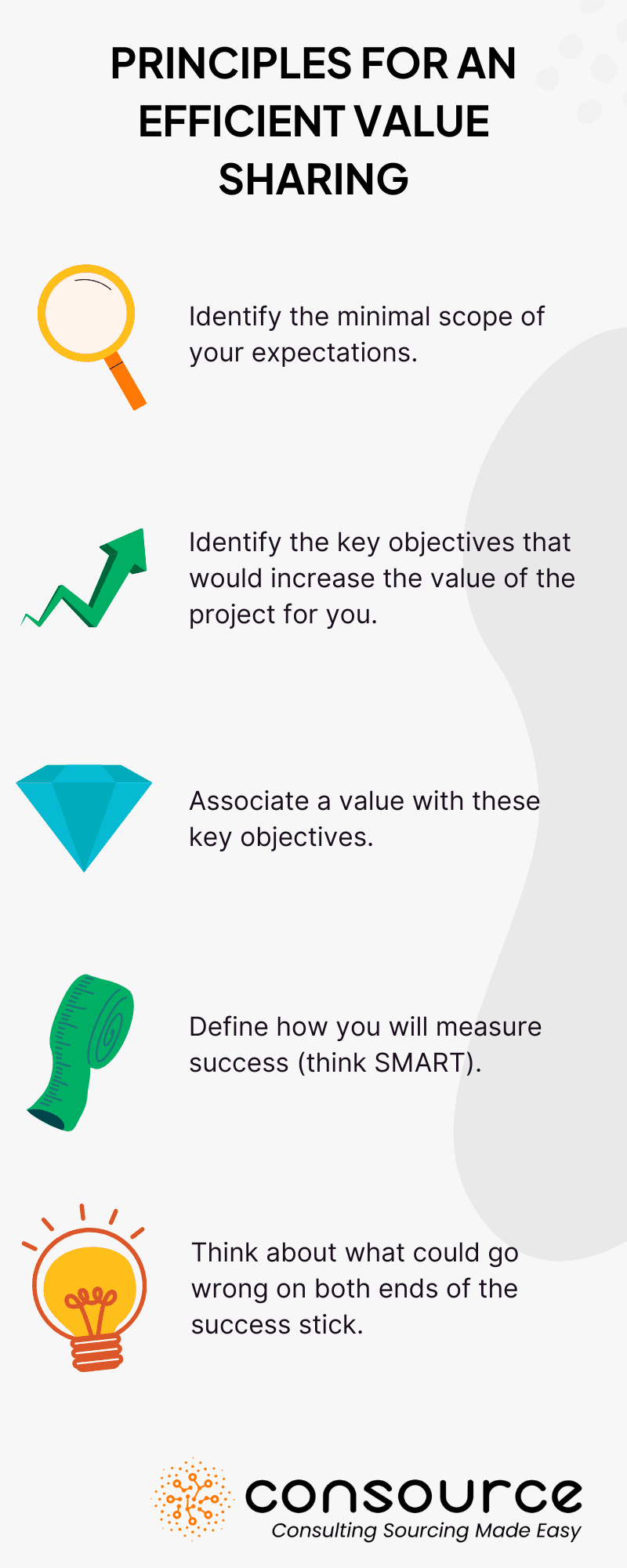

This category of fees is directly linked to project outcomes and/or client satisfaction, making them increasingly popular as they align the interests of the consultants with those of the client. Under this model, consultants might reduce their upfront fees, taking on more risk in anticipation of higher rewards if they exceed performance expectations. This approach not only aligns consultant incentives with project success but also suggests that consultants are confident in their ability to deliver significant results.

However, clients should be prepared to potentially pay more than they would under a flat fee arrangement if the project achieves or surpasses its expected value. This is because consultants, having taken on additional risk, expect to be rewarded accordingly for exceptional outcomes.

Flat Fees + Satisfaction Bonus

This structure includes a typical flat fee supplemented by a discretionary bonus, which can be either a flat amount or a percentage of the project value. The discretionary nature of the bonus means that its issuance might depend heavily on the subjective assessment of results by the client, which can lead to frustrations on both sides due to its subjective nature.

Flat Fees + Performance Bonus

This is the most common arrangement within performance-based fees. It is particularly effective for projects with easily measurable outcomes, such as cost reduction or revenue growth. The scheme may include an intricate mechanism of objectives and thresholds. It can also be adapted to more intangible goals, provided they can be quantified through SMART objectives and the consultant’s impact on the results can be clearly isolated.

Percentage-Based Fees

In this scenario, the flat fee might be minimal or even nonexistent, with consultants being compensated via a percentage of the transaction or project value. This structure is frequently used in M&A scenarios where consultants also perform facilitation and brokerage roles, and it can be applied to cost-cutting initiatives as well.

Equity-Based Fees

Commonly used among fast-growing startups or in turnaround situations where cash may be scarce, this model allows consultants to receive equity as part of their compensation. This aligns their efforts directly with the company’s value creation, motivating consultants to focus on substantial, impactful results. The consultants adjust their resource allocation to balance the potential risks and returns, thus linking their success directly to the success of the company.

How to Select the Right Fee Structure for a Consulting Project?

Understanding the consulting industry is crucial for optimizing your consulting spend. Knowing your fee structure options enables you to explore innovative solutions and maximize the value you get for your budget.

If your organization is new to using consultants, opting for a flat fee structure while carefully verifying the declared workload can be the safest approach. This provides predictability in costs and ensures clarity in what you’re paying for.

For organizations with more experience and a desire to incentivize consultants to achieve exceptional results, consider exploring performance-based fees and risk/reward sharing schemes. These structures align consultant incentives with project outcomes, motivating them to go above and beyond to deliver measurable value.

If your project is still in its early stages or the scope is uncertain, implementing a daily rate structure with regular weekly follow-ups can help keep costs under control. This approach allows for flexibility in adapting to evolving project needs while maintaining oversight on expenditures.

It’s essential for procurement leaders and business units to evaluate and decide on the most suitable fee structure for each consulting project. This decision should be guided by thorough consideration of project complexity, desired outcomes, and risk tolerance.

If you’re unsure about which fee structure might be the best fit for your project, we’ve developed a tool that can help guide you through the decision-making process. This tool considers your project specifics and provides tailored recommendations. Check out our fee assessment tool here to find the most suitable fee structure for your needs.

Putting a Bow on the Consulting Fees Conundrum

Ah, consulting! A world where time is not just money; it’s a meticulously calculated, often-debated currency. Many see consultants as the high-flying wizards of the corporate world, jetting in with their briefcases, only to leave behind invoices that might make one choke on one’s morning tea.

However, understanding the math and magic behind their fees can shift the narrative from shock to sense. The dance between cost and value is age-old. So, when deciphering the enigmatic world of consulting fees, remember that beneath the numbers lies the promise of expertise, knowledge, and potentially transformative solutions for your business.

While the intricacies of pricing can get as complex as a Sunday crossword, it’s imperative to cut through the jargon and see the real worth consultants bring. You see, when it comes to consulting, it’s not just about paying someone to solve your problems, but investing in a partner that can steer the ship while navigating the stormy seas of business challenges.

Whether you opt for workload-based fees or a cheeky hybrid-type, the crux remains – you’re not just buying time, you’re acquiring value. So, the next time you find yourself pondering over a consultant’s invoice, take a moment to discern the value beneath the numbers. For, in the grand tapestry of business, consultants could very well be the thread that brings it all together.

And as always, when in doubt, perhaps consult about consulting and give us a call? A touch ironic, but then, that’s business for you. Cheers!

Frequently Asked Questions

What factors influence consulting fees?

Consulting fees are influenced by the consultant’s expertise, the project’s complexity, time requirements, team composition, industry specifics, and additional expenses.

How do performance-based consulting fees work?

Performance-based fees are linked to achieving predefined goals, such as cost savings or revenue increases. They often include a base fee with a success bonus upon reaching targets.

What are the advantages of flat fee structures?

Flat fees provide predictability and budget control, making them suitable for large projects with well-defined scopes. They allow clients to assess ROI more effectively.

How can clients manage part-time consulting assignments?

To manage part-time assignments, clients should establish clear deliverables, maintain regular communication, and track consultant contributions to ensure alignment with project goals.

What are equity-based consulting fees?

Equity-based fees involve trading consulting services for company equity, commonly used with start-ups or in turnaround situations to align consultant incentives with client success.

When should clients consider retainer fees?

Retainer fees are ideal for ongoing support needs, providing consistent access to a consultant’s expertise and ensuring priority for upcoming projects.

0 Comments