Les honoraires de conseil sont souvent traités comme s'ils étaient gravés dans le marbre - des propositions brillantes, des pyramides d'effectifs lourdes de partenaires et des "cartes de tarifs globaux" qui semblent intouchables. Mais voici la vérité que tous les responsables des achats et les dirigeants d'entreprise devraient connaître : les honoraires des consultants sont négociables. Pas seulement par 5 ou 10%, mais parfois par la moitié ou plus.

Prenons l'exemple d'un projet récent. Le client avait émis un appel d'offres d'à peine deux pages. Les propositions reçues se situaient entre 600 000 et 5 millions d'euros pour le même projet. Ce n'est pas un marché, c'est une loterie. Au lieu de choisir le chiffre le moins absurde, nous avons travaillé différemment. En clarifiant le champ d'application, en échelonnant le travail, en remettant en question la pyramide des effectifs et en appliquant une approche axée sur les coûts ("nous n'avons que 1 million d'euros pour ce projet"), nous avons obtenu un cabinet de conseil de niveau 1 pour 1,1 million d'euros.

Voici la leçon essentielle : la délimitation du champ d'application et la fixation du prix ne sont pas des étapes successives. La plupart des entreprises pensent qu'il faut d'abord définir l'étendue du projet, puis négocier les honoraires. C'est faux. La manière dont vous définissez le périmètre du projet influe sur les honoraires que vous pouvez négocier, et la manière dont vous négociez les honoraires vous oblige souvent à repenser le périmètre du projet. Les deux leviers doivent être actionnés en parallèle.

Cet article démonte le mythe des honoraires de conseil "fixes", explique le fonctionnement de la tarification et vous donne un guide pratique pour négocier en position de force, sans compromettre l'impact de vos projets ou vos relations avec vos partenaires de conseil.

Pourquoi les honoraires de conseil sont-ils perçus comme une boîte noire ?

Le conseil est l'une des catégories de dépenses les moins transparentes. Contrairement aux produits de base ou aux licences de logiciels, il n'y a pas de références publiques, pas de modèles de livraison standardisés et pas de règles de tarification claires. Cela ne signifie pas que les consultants sont malhonnêtes - cela reflète simplement la nature d'une activité basée sur des projets et axée sur l'expertise. Chaque projet est unique et chaque entreprise apporte sa propre façon de fournir de la valeur.

Derrière les propositions alléchantes, voici ce qui fait réellement grimper les coûts du conseil :

- Multiplicateurs de salaire - les consultants sont facturés à un multiple de leur salaire de base pour couvrir les frais généraux, les investissements de l'entreprise et les bénéfices.

- Primes de marque - Les entreprises de niveau 1 facturent plus cher non seulement pour leur expertise, mais aussi pour la crédibilité que leur nom apporte devant les conseils d'administration et les investisseurs.

- Frais généraux et coûts cachés - la gestion des connaissances, la recherche interne ou les sous-traitants peuvent être inclus dans les honoraires.

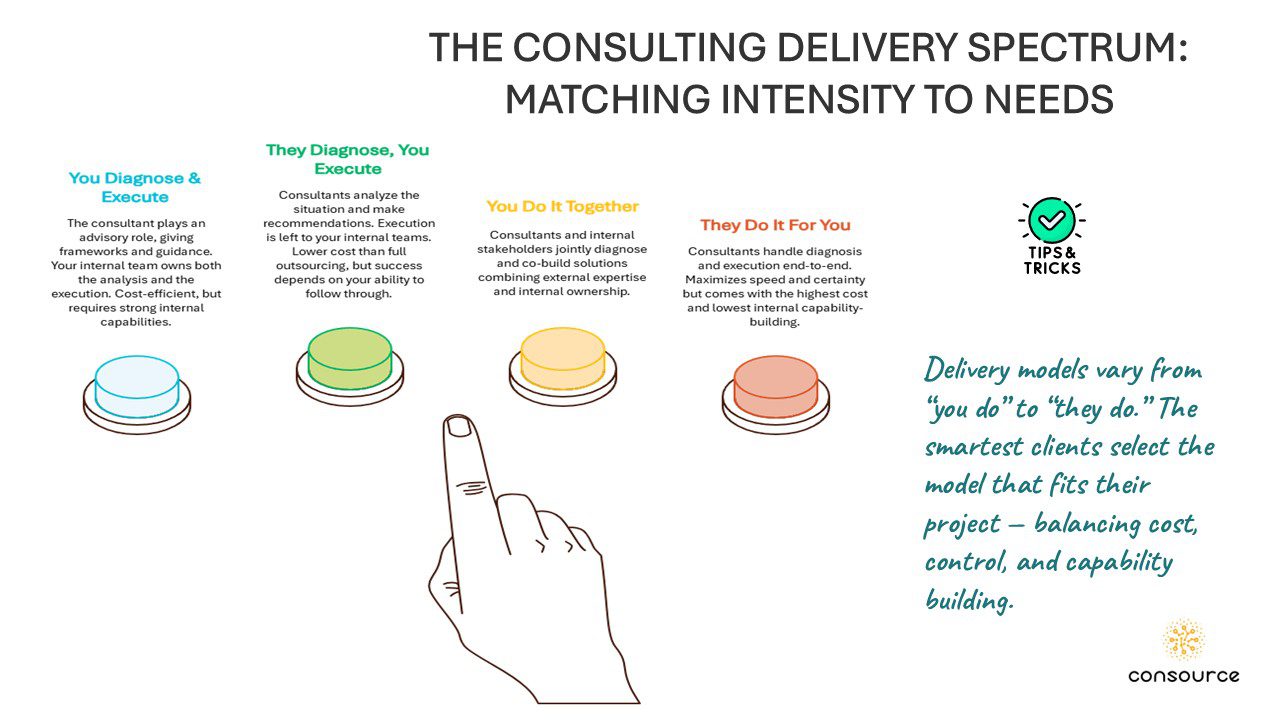

- Intensité de livraison - l'élément le plus important. Une approche de facilitation "légère" avec trois consultants ne coûtera qu'une fraction d'un engagement "approfondi" avec huit consultants produisant des analyses comparatives granulaires. Les deux approches peuvent être valables - tout dépend de ce dont vous avez besoin.

Et c'est là que le bât blesse : lorsque vos besoins ne sont pas clairement définis, les consultants ne peuvent que formuler des hypothèses. Certains cabinets concevront des approches globales et gourmandes en ressources. D'autres proposeront des modèles plus légers. Les deux peuvent être raisonnables, mais le manque de précision du côté du client est ce qui conduit à des écarts de propositions allant de 600 000 euros à 5 millions d'euros pour le même projet.

C'est la raison pour laquelle la tarification des services de conseil semble être une boîte noire. Il ne s'agit pas de "consultants cupides", mais de les modèles de prestation, la clarté du champ d'application et le risque perçu. C'est la raison pour laquelle il est erroné de considérer la définition du champ d'application et l'établissement du prix comme des étapes distinctes et linéaires. La façon dont vous définissez le projet détermine la marge de manœuvre dont vous disposez en matière de tarification, tandis que la négociation des honoraires oblige souvent à une nouvelle conversation sur l'importance réelle de l'étendue du projet.

L'opacité n'est pas incassable. Une fois que l'on a accepté que le champ d'application et le prix sont des leviers interdépendants qu'il faut actionner en même tempsVous commencez ainsi à créer de la transparence et de la valeur, transformant le conseil en un investissement bien géré.

La psychologie de la tarification des services de conseil

Si les honoraires de conseil semblent opaques, ce n'est pas seulement à cause des modèles de prestation et des frais généraux. C'est aussi à cause de la psychologie qui sous-tend la façon dont les entreprises présentent leurs prix - et la façon dont les clients les perçoivent. Les consultants sont des experts non seulement dans la résolution de problèmes, mais aussi dans la gestion des attentes et l'élaboration de la perception de la valeur.

Voici trois dynamiques psychologiques que tout acheteur doit reconnaître :

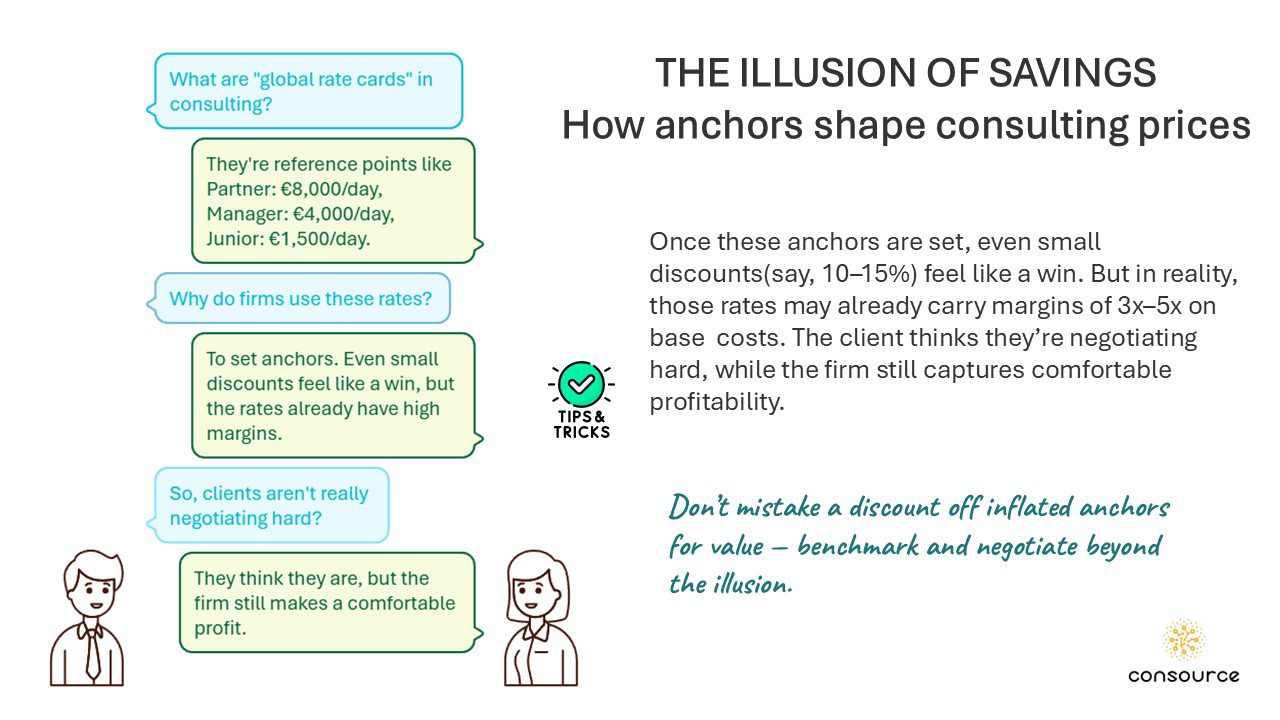

1. L'ancrage par les cartes de taux

L'une des tactiques les plus courantes consiste à ancrage. Les cabinets présentent des "cartes de tarifs globaux" ou des fourchettes d'honoraires journaliers qui établissent un point de référence dans l'esprit du client. Un taux d'associé de 8 000 euros par jour et un taux de junior de 1 500 euros par jour peuvent sembler élevés, mais une fois qu'ils sont sur la table, ils deviennent le point d'ancrage de toute négociation. Même une remise de 10% semble alors être une victoire - alors qu'en réalité, les tarifs peuvent déjà représenter une majoration de 3 à 4 fois par rapport aux coûts réels.

2. L'effet de prestige

Le prestige est important dans le domaine du conseil. Une entreprise de niveau 1 ne vend pas seulement son expertise, elle vend aussi sa crédibilité. Les conseils d'administration, les régulateurs et les investisseurs peuvent réagir différemment lorsque le logo de McKinsey, BCG ou Bain est apposé sur un rapport. Cette "prime de prestige" explique pourquoi les grandes entreprises pratiquent souvent des tarifs deux ou trois fois supérieurs à ceux des boutiques spécialisées. Il ne s'agit pas de cupidité, mais de la valeur de signalisation de leur marque.

Le défi pour les marchés publics ? Faire la distinction entre où le prestige est essentiel (par exemple, devant votre conseil d'administration ou vos régulateurs) et lorsqu'il s'agit simplement de une couverture de confort coûteuse.

3. Primes de risque lorsque les besoins sont vagues

Lorsque les clients n'ont pas une idée claire de la portée du projet, les consultants prennent en compte les risques. S'ils s'attendent à des itérations interminables, à des livrables mal définis ou à la résistance des parties prenantes, ils ajouteront des tampons - en termes de taille de l'équipe, de durée du projet ou d'heures de contingence. Moins vous êtes précis, plus vous paierez cher.

Cela nous ramène au principe clé : le cadrage et la tarification sont interdépendants et non séquentiels. Une mauvaise définition du champ d'application ne fait pas qu'embrouiller les fournisseurs : elle les invite à intégrer des primes qui gonflent les honoraires. Lorsque vous négociez les honoraires, vous ne vous contentez pas de faire baisser les tarifs ; vous remettez en question les hypothèses relatives à l'intensité de la livraison et au risque.

L'importance pour les acheteurs

Comprendre la psychologie qui sous-tend la tarification des services de conseil permet de changer la donne. Au lieu de réagir à des tarifs "non négociables" ou à des logos qui imposent la déférence, les responsables des achats peuvent recadrer les négociations autour de la valeur et des résultats :

- Cette prime de prestige vaut-elle la peine d'être payée ?

- Le modèle de prestation est-il proportionné à l'impact ?

- Sommes-nous en train de payer pour un risque qui pourrait être atténué par une délimitation plus claire du champ d'application ?

Il ne s'agit pas de vilipender les consultants - ils gèrent des entreprises comme les autres. Il s'agit de reconnaître les leviers psychologiques en jeu afin de pouvoir les contrebalancer avec les vôtres.

Déconstruction du barème des droits

Il est désormais clair que les honoraires de conseil ne sont pas le fruit du hasard. Ils sont le produit d'un modèle d'entreprise bien défini, qui combine les coûts, les choix de prestation et les marges. Comprendre ce modèle est la clé d'une négociation efficace.

Décortiquons les principaux éléments :

1. Multiplicateurs de salaire et utilisation

Les consultants sont facturés à des multiples de leur salaire de base. Un junior qui gagne 80 000 euros par an peut être facturé 1 000 euros par jour. Pourquoi cet écart ? Parce que les entreprises doivent couvrir leurs frais généraux (formation, gestion des connaissances, personnel de soutien) et leurs bénéfices. Ajoutez à cela l'hypothèse d'une utilisation élevée - 70-80% du temps facturé aux clients - et vous commencez à comprendre comment des multiplicateurs de 3x à 5x apparaissent.

Pour les marchés publics, l'idée n'est pas que les multiplicateurs sont "faux" - ils soutiennent l'économie de l'entreprise - mais que ils sont négociables. Les entreprises appliquent des multiplicateurs différents, et vous pouvez contester l'adéquation entre la prime et la valeur.

2. La pyramide des effets de levier

La plupart des projets de conseil suivent un modèle pyramidal : un associé au sommet, un ou deux directeurs au milieu et une base plus large de consultants juniors. Cet effet de levier permet aux entreprises de facturer une expertise de haut niveau tout en confiant la majeure partie du travail à du personnel moins coûteux.

Le problème ? La pyramide reflète souvent l'économie du cabinet plus que les besoins du client. Un associé peut ne passer que quelques heures par semaine sur le projet, mais apparaître comme un facteur de coût important. Pendant ce temps, les clients peuvent payer trop cher pour une large base de juniors dont le travail consiste davantage à apprendre qu'à apporter une valeur ajoutée.

C'est là qu'intervient la négociation :

- Avez-vous besoin de trois gestionnaires ou d'un seul ?

- Le projet pourrait-il être mené à bien avec une équipe moins nombreuse et plus hiérarchisée ?

- Pouvez-vous remplacer les "armées d'analystes" par une expertise plus ciblée ?

L'ajustement de la pyramide peut facilement réduire les coûts de 15-25% sans affecter les résultats.

3. Frais généraux et coûts cachés

Les cabinets de conseil incluent des frais généraux pour une bonne raison : ils investissent dans des centres de connaissances, des outils exclusifs et des recherches internes. Mais en tant que client, vous devez savoir ce qui est inclus dans votre facture :

- Frais de voyage et de séjour (T&E) - souvent facturés séparément, parfois généreusement.

- Sous-traitants - experts externes facturés au tarif des consultants.

- Recherche et données - abonnements transformés en frais de projet.

Il ne s'agit pas de coûts illégitimes, mais ils sont leviers négociables. Par exemple, vous pouvez plafonner les frais de déplacement, demander la transparence sur les sous-traitants ou acheter certaines données directement au lieu de payer une majoration pour les services de conseil.

4. Intensité de l'exécution et granularité des projets

Comme nous l'avons vu précédemment, le principal facteur de fluctuation est la conception de la prestation. Une "plongée en profondeur" avec des analyses comparatives approfondies et des ateliers quotidiens coûtera naturellement plus cher qu'une facilitation légère avec des analyses ciblées. Ni l'un ni l'autre n'est mauvais, mais vous devez être en mesure de choisir ce pour quoi vous payez.

L'union fait la force : De la boîte noire à la transparence

Une fois que l'on décompose les honoraires de conseil en leurs différents éléments - multiplicateurs, pyramides, frais généraux et intensité de la prestation - la boîte noire se transforme en tableau de bord. Vous voyez quels leviers peuvent être ajustés, lesquels sont structurels et lesquels sont à négocier.

Et là encore, c'est la clé : la délimitation du champ d'application et la tarification sont étroitement liées. La remise en question de la structure des honoraires conduit souvent à une refonte du champ d'application, et l'ajustement du champ d'application influe directement sur les honoraires. C'est en les traitant ensemble que l'on passe d'une tarification "à prendre ou à laisser" à un accord équitable, fondé sur la valeur.

Les leviers pour optimiser les honoraires de conseil

S'il est un mythe à détruire une fois pour toutes, c'est bien l'idée qu'il faut d'abord définir le champ d'application et négocier ensuite. Dans le domaine du conseil, la portée et le prix sont les deux faces d'une même pièce - et les meilleurs résultats sont obtenus en jouant sur les deux leviers en même temps.

C'est là que notre cadre entre en jeu : deux familles de leviers, chacune ayant son propre rôle dans l'évolution des coûts et de la valeur.

1. Les leviers du scoping : Redéfinir ce que vous achetez

Le cadrage ne se limite pas à l'élaboration des produits à livrer. Il s'agit de façonner le projet de manière à en augmenter la valeur et l'efficacité.

- Clarifier les objectifs et les résultats: Un champ d'application flou invite à une ingénierie excessive et à des honoraires gonflés. Plus vous êtes clair, plus le modèle de livraison est allégé.

- Une ambition à la mesure de l'enjeu: Avez-vous vraiment besoin d'une transformation à 360°, ou un diagnostic ciblé sur les principaux points de douleur créera-t-il 80% de la valeur ?

- Phases du projet: Le découpage d'un projet en plusieurs phases permet de tester la valeur à un stade précoce, de limiter les risques et de négocier les honoraires de manière progressive.

- Optimiser la composition du personnel: Déterminez si vous avez besoin d'une armée de juniors ou d'une équipe plus petite et plus importante en nombre de seniors.

- Tirer parti des ressources internes: Certaines tâches (collecte de données, logistique, gestion de projet) peuvent être traitées en interne, ce qui réduit le nombre d'heures facturables.

💡 Exemple: Un client qui venait de subir une intégration antérieure a réduit ses besoins pour un projet de suivi. L'intégration ayant été retardée, la phase de "diagnostic" nécessaire était beaucoup plus légère, et la dimension RH n'était plus à l'ordre du jour. En redimensionnant le projet en conséquence, ils ont réduit les honoraires de conseil de près de 30%sans compromettre l'impact des travaux restants.

2. Les leviers de la tarification : Redéfinir le mode de paiement

Une fois que le champ d'application est clairement défini, la conversation porte sur la structuration des frais de manière à aligner les incitations et à optimiser les coûts.

- Tension concurrentielle: Utilisez des appels d'offres, des listes restreintes ou même des "appels d'offres fictifs" pour maintenir les prix à un niveau raisonnable.

- Remises et rabais: Négocier des remises sur le volume, des remises multi-projets ou des remises sur l'effort commercial.

- Modèles de redevances alternatifs: Dépasser les tarifs journaliers. Les honoraires fixes, les provisions, le partage des gains et les honoraires de réussite permettent d'aligner les coûts sur les résultats.

- Optimisation du T&E: Limiter les déplacements et les dépenses, exiger une approbation préalable ou opter pour une livraison virtuelle d'abord.

- Gestion des cartes tarifaires: Comparer les taux entre les entreprises, négocier des plafonds et établir des cartes de taux à long terme par le biais d'accords-cadres.

💡 Exemple: Une entreprise souhaitait cartographier ses processus financiers de bout en bout et a d'abord demandé à son partenaire de conseil en place de lui faire une proposition. Le résultat ? Une offre unique de 2,5 millions d'euros. Au lieu de l'accepter, nous avons créé une concurrence en invitant d'autres sociétés compétentes. Le résultat a été spectaculaire : le consultant en place a lui-même réduit ses honoraires de près de 1,5 million d'euros. 50%La société a accepté de mettre en jeu une partie des honoraires en fonction de la satisfaction du client et a même obtenu des honoraires préférentiels pour la phase de réingénierie à venir liée à la mise en œuvre du module SAP de Signavio.

3. Le véritable art : Jouer les deux familles ensemble

Le point essentiel à retenir est que ces leviers ne fonctionnent pas isolément. L'ajustement du champ d'application crée de nouvelles options de tarification, et les discussions sur la tarification déclenchent souvent des affinements du champ d'application.

- Si vous définissez un l'objectif de la conception au coût ("Nous ne disposons que d'un million d'euros pour ce projet"), vous combinez les leviers de la portée et du prix en un seul geste.

- Si vous échelonnez le projet, vous en réduisez la portée tout en ouvrant la voie à d'autres modèles de rémunération.

- Si vous remettez en question les modèles de recrutement, vous touchez simultanément au champ d'application (quels rôles sont nécessaires) et à la tarification (quels taux s'appliquent).

L'art de négocier des honoraires de conseil ne consiste pas à presser les fournisseurs, mais à la redéfinition du projet en collaboration avec eux - afin que la portée, la livraison et le prix correspondent à la valeur que vous attendez.

Jouer sur la portée et le prix en tandem

S'il est un domaine dans lequel les responsables des achats peuvent créer une valeur ajoutée considérable, c'est bien celui des jouer sur les leviers de la portée et du prix - en temps réel. Il ne s'agit pas de définir d'abord le périmètre et de négocier ensuite. Il s'agit d'itérer en parallèle sur le périmètre et les honoraires jusqu'à ce que la conception du projet corresponde à la valeur que vous recherchez.

L'un des moyens les plus efficaces d'y parvenir est la fonction l'approche "design-to-cost" (de la conception au coût). Au lieu de demander aux consultants "Combien cela va-t-il coûter ?", vous leur dites "Nous avons X euros à investir. Comment façonner le projet pour qu'il corresponde à ce montant ?"

💡 Exemple: Un client avait reçu deux propositions de sociétés de conseil de niveau 1 - toutes deux aux alentours de 800 000 euros - pour un projet d'une valeur réaliste d'environ 500 000 euros. Nous sommes intervenus et avons appliqué une approche "design-to-cost". Avec les consultants et les parties prenantes internes, nous nous sommes assis pour définir ce qui était vraiment essentiel au succès et ce qui pouvait être rationalisé ou échelonné. Le résultat ? Un projet remanié à €550k - une bien meilleure adéquation au budget et à la valeur attendue.

Et voici le plus drôle : il s'est avéré plus facile de convaincre les consultants d'adapter leur modèle de prestation que les parties prenantes internes de réduire leur liste de souhaits. Cela nous rappelle que l'optimisation des honoraires ne consiste pas seulement à pousser les fournisseurs, mais aussi à aligner les attentes internes.

Pourquoi ça marche

- Les consultants préfèrent la clarté: Lorsque vous leur donnez un budget ferme et des priorités claires, ils peuvent redéfinir les modèles de prestation avec plus d'assurance.

- L'alignement interne est essentiel: La résistance la plus forte vient souvent de l'intérieur de l'organisation - des parties prenantes qui veulent le "menu complet" même si le budget ne couvre que l'essentiel.

- Résultat gagnant-gagnant: Au lieu d'une bataille interminable sur les tarifs journaliers, la conception en fonction des coûts fait des honoraires un exercice conjoint de résolution de problèmes. Les consultants protègent leurs marges en se concentrant sur les éléments indispensables, tandis que le client s'assure que les dépenses sont proportionnelles à la valeur.

Au-delà du prix - Négocier la valeur

La plus grande erreur que commettent les entreprises lorsqu'elles négocient des honoraires de conseil est de s'arrêter au prix. Une remise de 10% semble intéressante sur le papier, mais si le projet n'a que peu d'impact, c'est de l'argent gaspillé. Une véritable négociation ne consiste pas à réduire les honoraires, mais à s'assurer que chaque euro dépensé apporte une valeur ajoutée à l'entreprise.

1. Recadrer la conversation autour du retour sur investissement

Le conseil ne doit jamais être considéré comme une discussion portant uniquement sur les coûts. Il s'agit d'un investissement. La bonne question n'est pas de savoir combien on peut économiser sur le tarif journalier, mais plutôt quel est le retour sur investissement de ce projet. En formulant les négociations en termes de résultats - amélioration de l'efficacité, augmentation des revenus, intégration plus rapide - les achats peuvent justifier les honoraires lorsqu'ils sont liés à une valeur mesurable.

Exemple : Au lieu de faire pression pour une autre remise 5%, une entreprise a structuré un élément de frais de réussite où une partie de la rémunération du consultant était liée à l'atteinte d'ICP opérationnels. Résultat ? Les consultants sont restés concentrés sur l'impact, et le client n'a payé que pour les résultats obtenus.

2. Bloquer l'effet de levier à long terme

L'un des meilleurs moyens d'optimiser les coûts de conseil est de ne pas se limiter à un seul projet.

- Accords-cadres: Établir des conditions préférentielles, des cartes de taux plafonnés et des mécanismes de gouvernance avec les entreprises sélectionnées.

- Panneaux: Constituer un portefeuille de fournisseurs (Tier-1, taille moyenne, boutiques) afin que chaque projet soit confié à la bonne entreprise au bon coût.

- Engagements de volume: Utiliser la visibilité de plusieurs projets pour négocier des rabais ou un traitement préférentiel.

Ces mécanismes permettent de réaliser des économies structurelles - 10-20% en moyenne - tout en donnant un effet de levier aux achats sans avoir à renégocier chaque contrat.

3. Se concentrer sur le bon partenaire, pas seulement sur le bon prix

Les responsables des achats doivent se rappeler que l'option la moins chère est rarement la meilleure. Un projet de conseil mal exécuté peut coûter beaucoup plus cher en perte d'opportunités qu'en honoraires. Négocier pour obtenir de la valeur signifie sélectionner des partenaires qui combinent :

- En forme avec votre culture et vos parties prenantes.

- Capacité pour obtenir les résultats dont vous avez besoin.

- Flexibilité d'adapter le champ d'application, le personnel et les honoraires en fonction de l'évolution de la réalité.

Lorsque ces trois éléments sont bien compris, même un tarif "plus élevé" peut apporter plus de valeur qu'une proposition au rabais.

Une vue d'ensemble

En fin de compte, la négociation des honoraires de conseil ne consiste pas à "gagner" contre les fournisseurs. Il s'agit de créer des engagements gagnant-gagnant où les consultants sont rémunérés équitablement et où les clients obtiennent une valeur mesurable. C'est cet équilibre qui permet aux relations de rester solides, aux projets d'avoir un impact et aux dépenses de conseil d'être maîtrisées.

Conclusion

Les honoraires de conseil ne sont pas gravés dans la pierre. Ils sont le résultat de choix - comment les projets sont délimités, comment la prestation est conçue, comment les risques sont évalués et comment les clients négocient efficacement. Trop souvent, les entreprises acceptent les propositions à leur valeur nominale, considérant l'étendue et la tarification comme des étapes séquentielles d'un processus. Cet état d'esprit est précisément la raison pour laquelle le conseil reste l'une des catégories de dépenses les moins optimisées.

La vérité est simple : le champ d'application et le prix sont des leviers interdépendants qui doivent être actionnés en parallèle. Si vous vous trompez, vous paierez des millions de dollars de trop. S'ils sont corrects, vous pouvez réduire les frais de 20-50% sans compromettre la qualité ou l'impact de vos projets.

Mais voici le tableau d'ensemble : la négociation des honoraires de conseil ne consiste pas à "écraser" les fournisseurs. Il s'agit de créer des engagements équitables, transparents et axés sur la valeur. Les consultants veulent avoir un impact ; les clients veulent payer en proportion de la valeur reçue. L'idéal est d'aligner ces intérêts grâce à un cadrage plus intelligent, à des structures d'honoraires innovantes et à des négociations axées sur le retour sur investissement.

Si vous souhaitez approfondir les stratégies pratiques, nous vous recommandons de lire les documents suivants Réduire les coûts de consultation de manière intelligente : Comment réaliser des économies sans compromettre les résultats".. Il complète cet article en montrant des moyens concrets pour les responsables des achats de réaliser des économies sans sacrifier l'impact.

Ainsi, la prochaine fois qu'une proposition de conseil arrivera sur votre bureau, ne la demandez pas : "Peut-on avoir une réduction ?" Posez plutôt la question : "Comment pouvons-nous redéfinir ensemble le champ d'application et la tarification afin que ce projet apporte une valeur maximale pour un coût correct ?

Et si vous êtes prêt à aller plus loin - à apporter discipline, structure et créativité dans votre façon de négocier les honoraires de conseil - nous sommes là pour vous aider.

👉 Réservez un appel de consultation gratuit avec Consource et construisons ensemble votre manuel de négociation. Ensemble, nous ferons en sorte que votre prochaine mission de conseil soit non seulement moins chère, mais aussi plus intelligente.

0 commentaires