La gestion des relations avec les fournisseurs fonctionne raisonnablement bien dans la plupart des catégories. Le conseil est l'exception.

Non pas parce que les équipes chargées des achats manquent de discipline ou d'ambition, mais parce que le conseil se trouve dans un no man's land peu commode. Il s'agit d'une activité stratégique, interfonctionnelle, difficile à définir et encore plus difficile à mesurer. Les responsables de catégorie savent généralement combien est dépensée en conseil, mais rarement en ce que l'argent réellement payé. Stratégie ici, transformation là, un peu de RH, un soupçon de communication - souvent avec les mêmes fournisseurs portant des chapeaux différents.

À cela s'ajoute la question structurelle : personne n'est vraiment propriétaire du conseil. Contrairement aux services de ressources humaines ou aux services financiers, le conseil est transversal aux unités opérationnelles et aux parties prenantes. Le retour d'information est dispersé, la mesure des performances est incohérente et les relations avec les fournisseurs tendent à reposer davantage sur les liens personnels entre les partenaires et les cadres que sur un cadre institutionnel formel.

Sans surprise, les MRS en pâtissent - une tendance que Consource a observée à maintes reprises dans l'ensemble des pays de l'Union européenne. les plus grands défis dans le domaine des services-conseils en approvisionnement. Les bilans d'activité sont parfois réalisés, mais ils sont souvent annuels, contractuels et rétrospectifs. La création de valeur, la qualité des prestations et le transfert de connaissances restent difficiles à évaluer. Et comme la visibilité est limitée, la gestion des fournisseurs devient réactive plutôt que stratégique.

C'est là que l'intégration des fournisseurs joue un rôle beaucoup plus important qu'on ne le croit généralement.

Dans la plupart des organisations, l'intégration est traitée comme un exercice de conformité : formulaires, validations, approbations, et le tour est joué. Pour le conseil...services intellectuels, Cette approche n'est pas seulement bureaucratique, elle est aussi contre-productive. L'onboarding devrait être le moment où la relation passe de l'étape de l'accueil à celle de l'intégration. personnel à institutionnelL'objectif est de mettre en place un système de gestion des relations avec les fournisseurs qui permette d'expliciter les attentes, la gouvernance et les méthodes de travail et de jeter les bases d'une gestion à long terme des relations avec les fournisseurs.

Lorsqu'il est bien conçu, le processus d'intégration des fournisseurs devient le premier levier du SRM - non pas un obstacle administratif, mais un point de contact stratégique. Et lorsqu'il est soutenu par une plateforme conçue spécifiquement pour le cycle de vie du conseil, comme Consource.io, il se connecte naturellement au sourcing, à la livraison du projet, au suivi des performances et à la stratégie catégorielle. .

C'est exactement ce qu'explore cet article : les meilleures pratiques en matière de gestion des relations avec les fournisseurs dans le domaine du conseil, En effet, Consource.io aide les équipes d'approvisionnement à gérer les fournisseurs de services-conseils avec la structure et la visibilité que la catégorie mérite.

1. Pourquoi l'intégration des fournisseurs est plus importante pour le secteur du conseil que pour toute autre catégorie ?

Dans de nombreuses catégories, l'onboarding est un portail. Vous le franchissez, vous entrez, et tout le monde poursuit sa vie.

Dans le domaine du conseil, l'intégration ressemble davantage à la définition des règles d'un jeu d'échecs, alors que les pièces sont encore en train d'être taillées et que la moitié des joueurs ne font qu'observer. C'est le moment où vous décidez si vous allez gérer les fournisseurs de conseil comme des partenaires stratégiques ou comme des rebondissements récurrents.

La consultation est services intellectuelsLes relations avec les fournisseurs sont : désordonnées, contextuelles, axées sur les personnes. Cela signifie que la relation avec le fournisseur sera soit conçu précoce... ou le sera improvisé plus tard. Dans le jazz, l'improvisation est un plaisir. En MRS, c'est cher.

1.1 Le conseil est stratégique. L'onboarding ne peut donc pas être une “administration avec un badge”.”

Le conseil ne se contente pas de produire des résultats. Il influence les décisions, les priorités, les modèles de fonctionnement et parfois même la manière dont les dirigeants envisagent leurs propres compétences (aïe). Pourtant, de nombreux processus d'intégration traitent le conseil comme s'il s'agissait de fournitures de bureau avec un meilleur PowerPoint.

Cette inadéquation crée le premier mode d'échec : les achats définissent un fournisseur comme étant “approuvé”, tandis que l'entreprise définit le fournisseur comme étant “digne de confiance”, et personne ne définit ce que cette confiance est censée produire, comment elle sera régie, ou ce qu'est une “bonne” chose au-delà d'un contrat et d'un tarif journalier.

Un conseil en matière d'intégration qui sert réellement la gestion des ressources humaines fait trois choses dès le premier jour :

- Clarifie l'objectifLe fournisseur : pourquoi ce fournisseur, pour quels types de travaux, dans quelles conditions ?

- Définit les règles d'engagementla façon dont l'entreprise et les services d'approvisionnement travaillent ensemble (oui, ensemble)

- Fixe des attentes en matière de valeurLes résultats : pas en poésie, en termes opérationnels - méthodes de travail, hygiène d'exécution, preuves d'impact

C'est ici que la numérisation cesse d'être un mot à la mode et devient pratique : la visibilité, l'efficacité, la gouvernance - ce ne sont pas des choses “agréables à avoir”. Il s'agit du système de contrôle minimum viable pour une catégorie stratégique.

1.2 La fragmentation ne se produit pas plus tard. Elle commence ici.

Le conseil en SRM échoue souvent pour une raison structurelle simple : le conseil est partout, il n'appartient donc à personne.

Les RH ont le “consulting”. Les finances ont des “conseils”. La transformation est “consultative”. La communication est “consultée”. Parfois, le même fournisseur fait tout cela, sous différents labels, différents propriétaires et différents récits (“ils sont des partenaires stratégiques” / “ils sont juste des mains supplémentaires” / “ils font cette chose que personne ne veut posséder”).

Les achats voient donc un chiffre total - souvent élevé - mais pas l'anatomie de ces dépenses. Et sans anatomie, le SRM devient du théâtre : vous pouvez examiner “le fournisseur”, mais pas la réalité.

L'intégration permet de réduire la fragmentation ou de l'institutionnaliser. Une approche mature utilise l'intégration pour établir :

- Une identité de fournisseur (et non quatre versions de la même entreprise dans quatre sous-catégories)

- Une classification commune du travail (ce qui relève de la consultation et ce qui relève des services intellectuels adjacents)

- Une base de gouvernance cohérente entre les parties prenantes et les unités opérationnelles

C'est précisément la raison pour laquelle une plateforme spécifique à une catégorie est importante : la centralisation des informations sur les fournisseurs et la normalisation des processus permettent d'éviter l'effet “univers parallèles” que les équipes chargées des achats ne connaissent que trop bien.

1.3 Les relations personnelles sont puissantes. C'est précisément la raison pour laquelle vous devez les institutionnaliser.

Soyons honnêtes : le conseil repose sur les relations. Le partenaire connaît vos dirigeants, vos politiques, vos points de pression. Il peut vous aider à avancer plus vite.

Ils peuvent également s'aider eux-mêmes à se déplacer plus rapidement.

Certaines entreprises accompagnent explicitement les consultants afin de créer une dépendance mutuelle : Je pense à toi et tu penses à moi. Traduction : votre carrière, mon pipeline. Ce n'est pas toujours cynique ; c'est simplement la façon dont la vente axée sur les relations évolue. Mais l'effet est réel : la relation peut devenir capital personnel au lieu de valeur organisationnelle.

Si votre SRM dépend de qui connaît qui, vous n'avez pas de SRM. Vous avez un réseau social avec des factures.

L'intégration est le moment de conserver la force humaine du conseil, tout en supprimant la fragilité institutionnelle. Non pas en “déromantisant” les relations, mais en les rendre gouvernables:

- Rôles et voies de décisionqui commandite, qui valide, qui arbitre lorsque la réalité s'écarte de l'énoncé des travaux

- Méthodes de travailles modalités d'évolution du champ d'application, les modalités de transfert des connaissances, les modalités de documentation des décisions

- Mécanisme de retour d'informationla manière dont vous recueillez des informations au-delà d'un seul sponsor (parce qu'un seul sponsor est... une opinion).

- Principes de performance: ce qui sera réexaminé, à quelle fréquence, sur la base de quels éléments probants

Si vous le faites dès le début, la relation survivra aux changements de personnel, aux réorganisations et à l'opération classique de conseil qui consiste à dire que votre partenaire préféré est désormais “responsable mondial‘ et qu'il est mystérieusement indisponible.’

1.4 L'onboarding axé uniquement sur la conformité revient à fixer une limite de vitesse et à l'appeler stratégie de conduite.

Oui, il faut des accords de confidentialité. Contrôles de sécurité. Des validations. Des approbations. Bien entendu.

Mais si l'intégration s'arrête là, vous avez mis en place une barrière de conformité, et non une relation avec le fournisseur.

En ce qui concerne le conseil, l'intégration dans le système SRM doit répondre à quatre questions pratiques que les documents de conformité ignorent poliment :

- Comment allons-nous régir les engagements entre les différentes parties prenantes ?

- À quoi ressemble le succès au-delà des résultats et des taux ?

- Comment recueillir des informations dans une catégorie dont le propriétaire n'est pas unique ?

- Comment conserver les enseignements, les points de référence et les signaux de performance, plutôt que de réinitialiser chaque projet ?

C'est à ce moment-là que l'intégration cesse d'être de la bureaucratie et devient le premier point de contact stratégique dans un cycle de vie plus large : de la qualification à l'approvisionnement, en passant par le suivi des livraisons et la gestion des performances des fournisseurs.élaborer une stratégie, acheter, livrer.

2. Les problèmes chroniques de SRM auxquels sont confrontées les équipes de consultants en approvisionnement

Si la consultation en matière de gestion des relations avec les fournisseurs semble plus difficile qu'elle ne devrait l'être, ce n'est pas parce que vos équipes ne sont pas assez performantes. C'est parce que la catégorie rompt discrètement avec la plupart des hypothèses sur lesquelles repose la gestion traditionnelle des relations avec les fournisseurs.

Les problèmes se répètent à l'infini, dans tous les secteurs d'activité et dans toutes les zones géographiques. Les symptômes sont différents, mais les mécanismes sous-jacents sont les mêmes. Et presque tous remontent à ce que l'on appelle le n'était pas structuré dès le début, souvent lors de l'accueil des nouveaux arrivants.

2.1 “Nous connaissons les dépenses”... sauf que ce n'est pas le cas

Demandez à la plupart des équipes chargées des achats combien elles dépensent en conseil et vous obtiendrez un chiffre. Demandez-leur ce que ces dépenses ont réellement financé, et la conversation devient soudain... interprétative.

Le travail stratégique est mélangé au soutien à la transformation. Le PMO se fond dans le renforcement opérationnel. La gestion du changement devient discrètement de la communication. Le même fournisseur apparaît sous plusieurs centres de coûts, champs d'application et récits, parfois au cours de la même année.

Il ne s'agit pas d'un problème de compétence. C'est un problème de visibilité.

Lorsque des fournisseurs de services de conseil sont recrutés sans qu'il y ait une classification claire des le type de travail qu'ils sont autorisés à effectuer, L'analyse des dépenses devient alors de l'archéologie rétrospective. On peut compter les os, mais la reconstitution du dinosaure relève de la devinette.

En l'absence de données structurées sur les fournisseurs et de règles d'intégration cohérentes, les discussions sur la gestion des relations avec les fournisseurs partent d'un terrain incertain : La question “Dépensons-nous trop ?” devient “Nous ne sommes pas tout à fait sûrs de ce que nous dépensons”. Ce n'est pas une bonne entrée en matière.

2.2 Mesure de la performance : Le silence gênant des réunions SRM

Il est notoirement difficile de mesurer la performance des services de conseil - et donc, souvent, elle n'est tout simplement pas mesurée.

Les analyses d'entreprises se concentrent sur ce qui est facile : tarifs, respect des contrats, volume de travail. Les questions plus difficiles...Cela a-t-il vraiment aidé ? L'impact en valait-il la peine ? Recommencerions-nous de la même manière ?-sont laissés poliment sans réponse.

Pourquoi ? Parce que les résultats du conseil sont des résultats partagés. Le succès dépend des équipes internes, de l'alignement des dirigeants, du calendrier et de l'exécution, et pas seulement du fournisseur. Cette complexité rend l'évaluation des performances inconfortable, en particulier lorsqu'il n'y a pas de cadre convenu.

En l'absence d'une méthode structurée pour recueillir les réactions des parties prenantes et des projets, la gestion des risques stratégiques devient anecdotique. Un sponsor a adoré le travail. Un autre est moins convaincu. L'approvisionnement se retrouve à arbitrer les opinions plutôt qu'à gérer les performances.

C'est précisément la raison pour laquelle la réflexion sur les performances doit commencer tôt, dès l'intégration, avant que les projets ne s'estompent dans la mémoire et que les récits subjectifs ne remplacent les preuves.

2.3 Une catégorie, plusieurs maîtres (et pas de véritable propriétaire)

Contrairement aux services de ressources humaines ou aux services financiers, le conseil n'a pas de domicile naturel. Il appartient à tout le monde, et donc à personne.

Il y a un vieux dicton : un esclave qui a deux maîtres est un homme libre. Le conseil vit souvent ce paradoxe. Avec de multiples sponsors, pas de propriétaire unique et une responsabilité floue, les fournisseurs opèrent avec une grande liberté, non pas parce que la gouvernance est forte, mais parce qu'elle est diluée.

Du point de vue du SRM, c'est là que les choses se gâtent. Qui est propriétaire de la relation ? Qui consolide le retour d'information ? Qui décide si un fournisseur est vraiment stratégique ou simplement bien connecté ?

En l'absence d'un cadre commun d'intégration et de gouvernance, la gestion des fournisseurs se fragmente en fonction des lignes organisationnelles. Le fournisseur s'adapte comme il le fait toujours. L'organisation perd sa cohérence.

Une approche SRM spécifique à la consultation tient compte de cette réalité et conçoit des processus qui fonctionnent. à travers centraliser l'information tout en permettant une pertinence locale.

2.4 Définition : Conseil vs Services (et le flou préféré de l'industrie)

La plus grande confusion n'est pas de savoir si un projet est “stratégique” ou “opérationnel”. Il s'agit de savoir si le fournisseur est conseiller ou faire-et comment chacun d'entre eux devrait être gouverné.

Les responsables des achats et les parties prenantes tentent souvent de distinguer le conseil des services en utilisant des signaux erronés : projet ou mandat, prix fixe ou temps et matériel, court ou long. Ces signaux décrivent des enveloppes commerciales et non le travail.

Une distinction plus utile est la suivante :

- Conseil = conseiller avec des produits à livrer et des résultats, soutenus par des méthodologies, des cadres, une propriété intellectuelle et des outils.

- Prestations de service = faire par la capacité d'exécution, les processus, la reproductibilité et la continuité opérationnelle.

Le hic, c'est que de nombreuses sociétés de conseil proposent intentionnellement les deux. Au cours des 5 à 10 dernières années, les revenus tirés du conseil (irréguliers par nature) ont été complétés par des services, des offres gérées et parfois des logiciels (prévisibles par conception). Ainsi, le même fournisseur peut vous conseiller sur une feuille de route le lundi et vous fournir une capacité d'exécution le mardi, souvent à un prix élevé.

Si vous ne comprenez pas bien la différence entre le conseil et les services, vous n'êtes pas responsable de la relation. C'est le fournisseur qui l'est.

Et c'est important, car les étiquettes de prix sont très différentes.

La consultation est tarifée pour la réflexion, la structuration et le conseil. Les services sont tarifés pour l'exécution et la capacité. Lorsque la frontière n'est pas explicite, il devient remarquablement facile pour les fournisseurs de vous “rouler dans la farine”, c'est-à-dire de vous fournir des services au prix du conseil. Par contre, l'inverse ne semble jamais se produire.

Le résultat est connu : des factures importantes qui sont difficiles à contester, car la nature du travail n'a jamais été clairement définie. S'agissait-il d'un conseil stratégique ? Ou s'agissait-il d'une exécution avec un badge de qualité supérieure ? En l'absence de clarté, les achats se retrouvent à négocier après coup, généralement en position de faiblesse.

Il ne s'agit pas de sémantique. C'est une question de contrôle. Si l'intégration ne définit pas le type de relation que vous établissez - conseil, services ou un mélange délibéré - vous donnez le pouvoir de fixation des prix, l'interprétation du champ d'application et la perception de la valeur directement au fournisseur.

Et une fois que c'est le cas, le MRS n'est pas seulement flou. Elle est performative.

2.5 Les bilans d'activité : Annuels, contractuels et généralement trop tardifs

La plupart des organisations examinent les performances des consultants au niveau des fournisseurs. Une fois par an. Parfois.

C'est déjà trop tard, mais c'est aussi une erreur fondamentale.

La performance en matière de conseil n'appartient pas à un fournisseur. Elle appartient à un projet. Et plus précisément, à la partenaire ou responsable de mission le diriger. Le conseil est un service intellectuel : ce qui détermine réellement les résultats, c'est l'expertise, le jugement et le leadership de la personne qui dirige le travail, et non le logo sur la diapositive. Et parfois, soyons honnêtes, le client joue aussi un rôle - plus que nous ne l'admettons habituellement.

En réalité, les évaluations des MRS reflètent rarement cette réalité. La plupart du temps, le retour d'information sur les performances se résume à une vague question...“Alors... que pensez-vous de ce fournisseur ?”-Les questions sont posées longtemps après la fin du projet. Il n'y a pas de distinction entre les projets, pas de différenciation entre les partenaires et pas de moyen structuré de saisir ce qui s'est réellement passé.

Souvent, les responsables des achats ne se rendent pas compte à quel point cela est trompeur. Un partenaire fort peut masquer des livraisons faibles. Un projet raté peut injustement entacher toute une entreprise. Une réalité nuancée s'effondre en une moyenne polie et sans engagement. À ce stade, la “performance des fournisseurs” devient un sondage d'opinion - utile pour les conversations, inutile pour les décisions.

Ce qui fonctionne réellement, c'est un retour d'information continu, au niveau du projet - léger, structuré et saisi au moment de la livraison. Non pas pour “noter les fournisseurs”, mais pour.. :

- distinguer les partenaires et les équipes, et pas seulement les entreprises

- construire des preuves plutôt que des anecdotes

- alimenter les futures décisions d'approvisionnement avec quelque chose de mieux que la réputation

Sans cette continuité, chaque nouveau projet de conseil commence par une amnésie collective. Et la MRS devient un rituel annuel au cours duquel tout le monde convient - sincèrement - que l'année prochaine, cette fois-ci, ce sera différent.

3. Meilleures pratiques en matière d'intégration des fournisseurs pour les services de conseil en gestion de la chaîne logistique (SRM)

Si nous avons diagnostiqué les problèmes, arrêtons maintenant de philosopher et commençons à concevoir des règles qui fonctionnent réellement.

Dans le domaine du conseil, l'intégration n'est pas une étape administrative ponctuelle liée à un contrat-cadre de services. Il s'agit d'une point de contrôle récurrent, Les fournisseurs doivent être conscients de l'importance de leur rôle, sensibles aux projets et étroitement liés à leurs activités. autorisé de faire - et pas seulement de ce qu'ils sont.

S'il est bien fait, l'onboarding des consultants répond très clairement à trois questions :

- Que peut faire ce fournisseur ?

- Qu'est-ce qu'ils ne peuvent pas faire ?

- Dans quelles conditions la relation s'applique-t-elle ?

Tout le reste est du bruit.

3.1 L'onboarding n'est pas “une fois pour toutes” - certaines règles doivent être réitérées

La plupart des entreprises partent du principe qu'une fois qu'un fournisseur a été intégré et que l'accord de partenariat commercial a été signé, le travail est terminé. En matière de conseil, cette hypothèse est risquée.

Certains éléments doivent être explicitement réitéré, surtout pour les projets sensibles :

- Confidentialité, les consultants travaillent avec des concurrents ou sur des marchés adjacents.

- Conflits d'intérêts, qui ne sont pas théoriques en matière de consultation, mais structurels

- Limites de l'information, Les questions relatives à la transformation, à la stratégie, aux fusions-acquisitions ou à la réglementation.

S'appuyer sur un contrat signé il y a des années n'est pas de la gouvernance. C'est de l'optimisme.

Une approche mature de l'onboarding traite ces éléments comme suit garanties contextuellesElles sont réaffirmées lorsque le projet l'exige, et pas seulement lorsque le fournisseur entre dans la base de données des fournisseurs. Cela protège l'organisation et lève l'ambiguïté pour les consultants qui, par défaut, travaillent dans des zones grises.

3.2 L'intégration est une question de portée : Ce qu'ils font et ce qu'ils ne font pas

L'un des échecs les plus fréquents de l'onboarding est de laisser le champ d'application délibérément vague.

De nombreuses sociétés de conseil faire prétendent qu'ils peuvent tout faire. D'un point de vue marketing, c'est une bonne chose. D'un point de vue SRM, c'est précisément ce qu'il faut limiter.

L'onboarding doit être explicite :

- Quels sont les types de consultation pour lesquels le fournisseur est qualifié ?

- Quelles sont les capacités approuvées ?

- Quelles sont les activités exclues ou nécessitant une validation spécifique ?

Vous n'êtes pas obligé de faire appel à un fournisseur pour toutes les capacités qu'il revendique. La qualification n'est pas une approbation ; c'est une permission avec des limites.

Ce point est essentiel pour deux raisons :

- Elle permet d'éviter les dérives déguisées en “valeur ajoutée”

- Il crée une base rationnelle pour la comparaison des fournisseurs et la stratégie de portefeuille.

Sans cette clarté, le SRM devient réactif : les fournisseurs se développent organiquement et les achats ne découvrent de nouvelles “capacités” qu'à l'arrivée des factures.

3.3 Conseil ou services : Décider tôt ou payer plus tard

Si un fournisseur fournit à la fois des conseils et des services, L'utilisation d'un système de gestion de l'information doit être explicite lors de l'accueil des nouveaux arrivants. Pas dans les notes de bas de page. Pas de manière implicite. Explicitement.

Pourquoi ? Parce que la gouvernance, la logique de tarification et les attentes sont fondamentalement différentes.

Les meilleures pratiques sont simples, même si l'exécution ne l'est pas :

- Un fournisseur, un contrat d'achat

- Le contrat établit une distinction claire entre les deux :

- travail de conseil (consultation)

- travaux d'exécution (services)

Même si plusieurs gestionnaires de catégories sont impliqués en coulisses - parce que le fournisseur traverse les catégories - la relation avec le fournisseur doit être cohérente. Les contrats fragmentés créent des opportunités d'arbitrage. Et les fournisseurs sont très doués pour les repérer.

Si vous ne structurez pas cela dès le départ, vous perdez le contrôle :

- la logique de tarification,

- l'interprétation du champ d'application,

- et le levier d'escalade.

Une fois de plus, les prix des services de conseil ont tendance à évoluer vers le bas en services beaucoup plus facilement que l'inverse.

3.4 Concevoir le processus pour le conseil - et non contre lui

De nombreuses grandes organisations s'enorgueillissent de processus d'intégration “robustes”. Dans le domaine du conseil, la robustesse se traduit souvent par l'exclusion.

Exigences typiques :

- des seuils de revenus minimums (par exemple, 10 millions d'euros ou plus),

- des délais de paiement extrêmement longs (120, 180 jours),

- de lourdes charges administratives conçues pour les fournisseurs industriels.

Résultat ? Les petites et moyennes entreprises de conseil - souvent les plus spécialisées, les plus innovantes et les plus efficaces - sont éliminées avant même que l'on ne s'intéresse à leur expertise.

Il s'agit d'une erreur structurelle.

En consultation, la qualité et l'expertise ne sont pas liées à la taille. Tout à fait. Certains des meilleurs consultants travaillent dans de petites structures précisément parce que c'est l'expertise, et non l'échelle, qui est le moteur de la valeur.

Un bon processus d'intégration fait la distinction entre

- ce qui est nécessaire pour la gestion des risques, et

- ce qu'est la bureaucratie accidentelle héritée d'autres catégories.

Si votre processus d'intégration élimine les fournisseurs par conception, Si l'on ne gère pas les risques, on réduit l'accès aux talents.

3.5 L'onboarding, un outil de conception SRM et non une porte de conformité

Ensemble, ces meilleures pratiques mènent à une conclusion simple :

le conseil en matière d'intégration est l'endroit où la gestion des risques opérationnels est conçue, et non pas l'endroit où les fournisseurs sont simplement approuvés.

Un processus d'intégration solide :

- réitère les règles essentielles lorsque le contexte l'exige

- définit clairement le champ d'application et les limites

- distingue explicitement le conseil des services

- maintient la cohérence de la relation avec le fournisseur, même entre les différentes catégories

- et est exigeante sans être excluante

C'est exactement la raison pour laquelle l'intégration ne peut pas être isolée du reste du cycle de vie du conseil. Il doit se connecter naturellement aux décisions d'approvisionnement, à la gouvernance du projet et au retour d'information sur les performances. Des plateformes comme Consource.io sont construites autour de cette logique : l'onboarding en tant que une base structurée et réutilisable, Il permet d'assurer la visibilité, la gouvernance et la cohérence entre les missions de conseil.

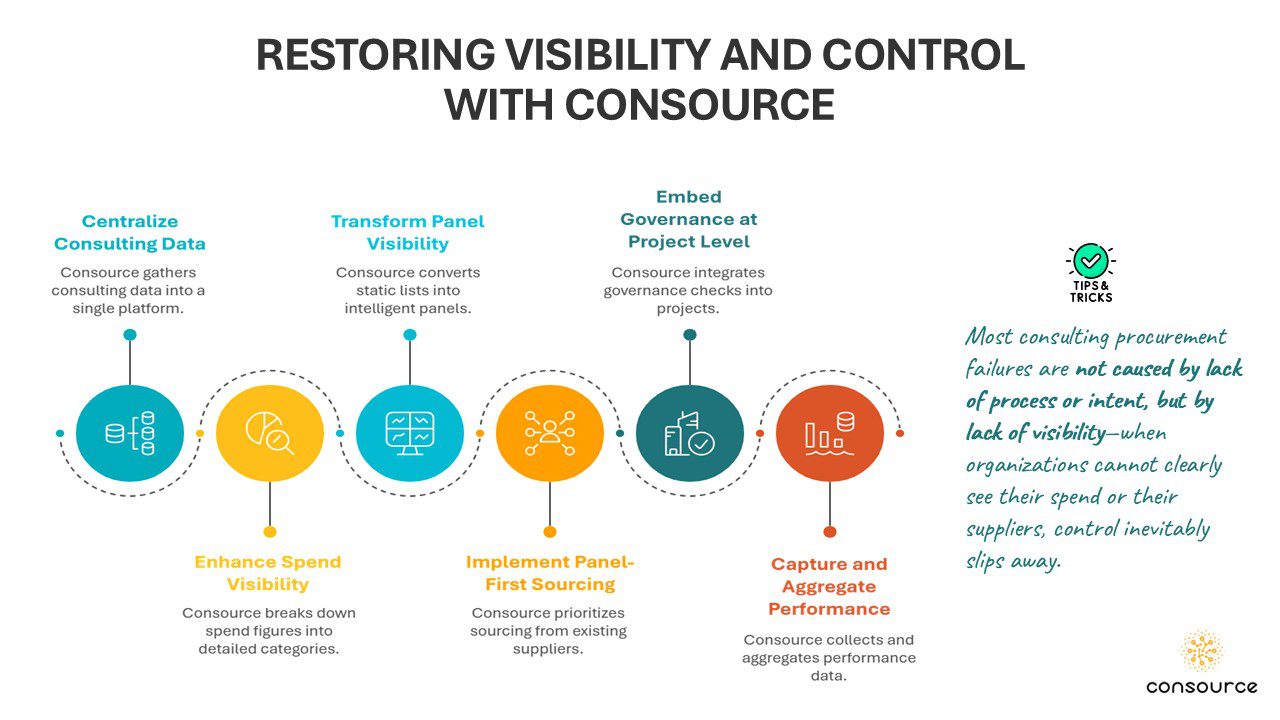

4. Comment Consource.io restaure la visibilité - et avec elle, le contrôle

Les achats de services de conseil posent de nombreux problèmes. Mais la plupart d'entre eux sont liés à deux problèmes fondamentaux : une visibilité limitée des dépenses et une visibilité limitée du panel de fournisseurs.

Lorsque vous ne voyez pas clairement qui sont vos principaux fournisseurs, ce qu'ils font réellement et à quel prix ils interviennent, tout ce qui se trouve en aval s'affaiblit - la gouvernance, la gestion des risques et la révision des activités.

Dans de nombreuses organisations, le conseil est considéré comme “géré” parce qu'il apparaît dans une arborescence de catégories et produit un chiffre de dépenses. Au quotidien, les parties prenantes appellent ceux en qui elles ont confiance, les fournisseurs influencent le processus d'approvisionnement et les achats formalisent principalement les décisions une fois qu'elles ont été prises.

4.1 Visibilité des dépenses : Connaître les chiffres n'est pas connaître les dépenses

La plupart des équipes chargées des achats de services de conseil sont en mesure de produire un chiffre de dépenses totales, mais elles ont encore du mal à le faire. visibilité des dépenses de conseil. Ce qu'ils peinent à faire - de manière cohérente - c'est d'expliquer ce que ce chiffre signifie. contient.

Poser une simple question de suivi -qu'avons-nous acheté exactement ?-et le ton change. La réponse est généralement sensée, mais dispersée. Une partie est affectée à la stratégie, une autre à la transformation, une troisième au “soutien”. Le même fournisseur apparaît sous différents centres de coûts, différents noms de projets, parfois différentes histoires. Chacun a sa pièce du puzzle, et le puzzle n'est jamais assemblé.

Ce n'est pas de la paresse. Il s'agit d'un angle mort structurel. Les dépenses de conseil se répartissent entre les parties prenantes et les projets de manière si efficace que la consolidation devient une belle idée plutôt qu'une habitude. Les achats se retrouvent avec un chiffre qui semble rassurant dans un tableau de bord, mais qui reste étrangement peu utile dès que l'on essaie de gérer la catégorie.

C'est ici que Consource gagne sa place. En centralisant les projets de conseil, les données sur les dépenses et les informations sur les fournisseurs, il donne aux achats une vision lisible de la manière dont le conseil est réellement utilisé : quels fournisseurs sont engagés, sur quels types de projets ils travaillent, quelles parties prenantes font appel à eux et à quels niveaux de prix. Les tendances cessent d'être une surprise après l'approbation des factures et commencent à apparaître suffisamment tôt pour influencer les décisions.

Une fois que cette visibilité existe, les trois questions fondamentales cessent d'être une expédition archéologique mensuelle :

- Qui sont nos principaux fournisseurs de services de conseil ?

- Quels sont les types de projets sur lesquels ils travaillent ?

- À quels niveaux de prix s'engagent-ils ?

Lorsque les achats peuvent répondre à ces trois questions, les conversations avec les fournisseurs deviennent soudain concrètes. Dans le cas contraire, tout le monde se rabat sur la réputation, les relations et le dernier projet en date.

4.2 Visibilité du panneau : Approuvé ne signifie pas connu

La deuxième faiblesse structurelle de la passation de marchés de conseil est le panel de fournisseurs lui-même.

La plupart des organisations disposent techniquement d'une “liste de fournisseurs agréés”. En pratique, il s'agit d'un registre statique qui ne répond qu'à une seule question : Ce fournisseur est-il autorisé à travailler avec nous ?

Ce qu'il ne répond pas est bien plus important :

- Qui peut faire quoi ?

- Qui est vraiment bon dans quoi ?

- Qui doit être utilisé pour ce type de projet - et qui ne doit pas l'être ?

Consource Pour remédier à cette situation, le panel de fournisseurs est traité comme un objet SRM vivant, Il s'agit d'un outil de gestion des fournisseurs, et non d'un artefact de conformité. Grâce à un tableau de bord des fournisseurs et à un outil SRM intégré, les fournisseurs sont gérés sous deux angles à la fois :

- Vue d'ensemble de l'approvisionnement : contrats, champ d'application, dépenses, performance, gouvernance

- Le point de vue des parties prenantes : capacités, pertinence, résultats antérieurs, forces perçues

C'est ainsi que l'on passe du statut de “fournisseur agréé” à celui de "fournisseur de services". panneau intelligent - qui soutient les décisions d'approvisionnement au lieu de les valider passivement.

4.3 L'approvisionnement en premier lieu (pour ne plus réinventer la roue à chaque fois)

Dans de nombreuses organisations, la recherche de fournisseurs de services de conseil commence toujours de la même manière :

“Qui connaissons-nous ?”

Consource renverse cette logique en appliquant une règle de approche par panel. Lorsqu'un projet est lancé, le point de départ n'est pas les réseaux personnels ou les recommandations de dernière minute, mais l'écosystème de fournisseurs existant - déjà qualifié, déjà régi, déjà visible.

Cela a deux effets immédiats :

- Il discipline le sourcing sans le ralentir

- Elle oblige l'organisation à réutiliser les connaissances au lieu de les remettre à zéro.

L'approvisionnement par panel n'a pas pour but de restreindre le choix. Il s'agit de rendre le choix possible intentionnel.

4.4 Gouvernance au niveau du projet : La NDA et les conflits d'intérêts ne sont pas des événements ponctuels

Vous avez très clairement souligné ce point, qui est l'un des aspects les plus négligés de la consultation en matière de MRS.

Un accord de confidentialité signé il y a plusieurs années ne vous protège pas dans le cadre d'un projet sensible aujourd'hui - la gouvernance doit être activement conçue, notamment par le biais d'un accord de confidentialité. accord de conseil gagnant. Une clause de conflit d'intérêts dans une MSA ne permet pas de gérer les conflits en soi.

En Consource, des mesures de gouvernance telles que Les accords de confidentialité et les vérifications des conflits d'intérêts sont intégrés au niveau des projets., Elles ne sont pas enfouies dans des contrats historiques. Cela signifie qu'ils peuvent être réitérés lorsque le contexte l'exige - exactement là où le risque de consultation existe réellement.

Il ne s'agit pas d'ajouter des frictions. Il s'agit de lever l'ambiguïté - pour le client et pour le fournisseur. Les zones grises sont confortables pour les consultants. Elles sont coûteuses pour les organisations.

4.5 La performance là où elle doit être, puis agrégée là où elle est utile

La performance en matière de conseil ne peut être mesurée de manière significative une fois par an, au niveau des fournisseurs, sur la base de vagues impressions. Vous l'avez dit vous-même.

L'activité de Consource est simple :

- Les performances sont saisies au niveau du projet, La livraison est encore fraîche.

- Le retour d'information reflète la réalité : ce qui a fonctionné, ce qui n'a pas fonctionné, dans quelles conditions.

- Ces données sont ensuite agrégé au niveau du fournisseur pour soutenir les analyses d'entreprise.

Cela permet d'éviter le piège classique des MRS :

- punir les bons partenaires pour les échecs des autres,

- ou la protection de livraisons faibles derrière une marque forte.

Les évaluations d'entreprises cessent d'être des conversations diplomatiques et deviennent des discussions fondées sur des preuves.

Conclusion - Si l'onboarding est vague, vous avez déjà perdu le contrôle

Dans le domaine du conseil, l'ambiguïté n'est pas neutre. Elle est rentable, mais rarement pour le client. Lorsque l'intégration ne définit pas clairement ce qu'un fournisseur est censé faire, ce qu'il n'est pas autorisé à faire et dans quelles conditions la relation s'applique, le fournisseur comble les lacunes. Le champ d'application s'étend. Les prix suivent. Et les achats se retrouvent à expliquer des factures qu'ils n'ont jamais vraiment régies.

C'est la raison pour laquelle la consultation en matière de gestion des risques stratégiques donne si souvent l'impression d'être impuissante. Non pas parce que la catégorie est impossible à gérer, mais parce que le contrôle est cédé tôt, discrètement, sous l'étiquette de la “flexibilité” ou de la “confiance”. Les cabinets de conseil n'ont pas besoin d'enfreindre les règles lorsque celles-ci n'ont jamais été explicitées. Et une fois que les projets sont en cours, il est déjà trop tard pour prétendre que la conversation porte toujours sur la stratégie.

L'intégration est le dernier moment où la relation peut être façonnée avant que l'argent, l'influence et la dynamique de livraison ne prennent le dessus. Considérez-la comme un acte administratif et vous hériterez de la relation préférée du fournisseur. Traitez-la comme un acte stratégique et vous déciderez de la manière dont le conseil est utilisé, tarifé, régi et évalué - projet par projet, partenaire par partenaire.

Consource.io existe précisément pour cette raison : donner aux équipes de consultants en achats un moyen d'imposer la clarté là où la catégorie y résiste naturellement, et la structure là où le pouvoir informel l'emporte habituellement.

Réserver une visite guidée gratuite de Consource.io et découvrez comment vos achats de services de conseil peuvent enfin fonctionner comme il se doit.

0 commentaires